Credit Score and Loan Eligibility in UAE (2025)

Your credit score UAE is a three-digit number that reflects how likely you are to repay borrowed money. In the UAE, this score — ranging from 300 to 900 — is issued by the Al Etihad Credit Bureau (AECB) and plays a key role in how banks decide loan approvals, credit limits, and interest rates.

Alongside AECB evaluations, the Central Bank of the UAE (CBUAE) enforces lending rules such as the 50% Debt-Burden Ratio, which determines your overall loan eligibility. Understanding both factors is essential if you plan to apply for a personal loan, car loan, or mortgage.

This guide explains what your credit score means, how lenders assess it, and what practical steps you can take to improve approval odds and financial stability.

What is a Credit Score in the UAE?

A credit score in the UAE is a three-digit number between 300 and 900 produced by the Al Etihad Credit Bureau (AECB). It measures your creditworthiness — the likelihood that you will repay borrowed money on time.

Lenders, banks, and finance companies rely on your AECB score to assess risk before offering loans, credit cards, or mortgages. A higher score signals lower risk and helps you qualify for lower interest rates, faster approvals, and larger loan amounts. A low score can result in rejection, higher prices, or the need for collateral or a guarantor.

Your score changes over time based on payment behavior, credit card use, outstanding debt, the length of your credit history, and the number of new credit applications. Even non-loan events, like missed utility or telecom payments or bounced cheques, are reported and can negatively affect the score.

You can check your score or full report via the official AECB website or mobile app, or through government portals such as DubaiNow and TAMM. As of 2025 the fee is AED 10.50 for the score and AED 84 for the full report. The full report shows payment history, open accounts, outstanding debt, inquiries, and any legal defaults.

AECB Score Bands (2025)

Scores are generally interpreted as follows:

- 800–900: Excellent — very low risk; best rates and fastest approvals

- 740–799: Very good — low risk; competitive rates and higher limits

- 670–739: Good — moderate risk; standard approval with typical terms

- 580–669: Fair — higher risk; may qualify but with higher rates

- 300–579: Poor — high risk; likely rejection or strict conditions

A strong score affects more than borrowing: it influences access to rental contracts, postpaid mobile plans, and premium banking products.

Managed by the Al Etihad Credit Bureau (AECB)

The AECB is the UAE’s federal credit bureau, supervised by the Central Bank. It collects financial data from banks, finance companies, telecom operators, utility providers, courts, and government entities. This consolidated data helps lenders make consistent credit decisions across the country.

Because data is aggregated from many sources, small issues — such as a missed telecom bill or a bounced cheque — can be visible to lenders. For this reason it’s advisable to review your AECB report regularly, at least twice a year, and to use the bureau’s data correction process if you find errors. Corrections are typically resolved within about ten working days once the reporting institution validates your documents.

How Credit Scores Are Calculated

AECB uses a weighted algorithm. The main factors and approximate weights are:

- Payment history: 35 percent. Timely payments on loans, credit cards, and utilities are critical. Missed payments damage the score quickly.

- Credit utilization ratio: 30 percent. This is the proportion of used credit against total available credit. Keeping utilization under 30 percent is recommended.

- Length of credit history: 15 percent. Longer histories are better.

- Credit mix: 10 percent. A balanced combination of revolving and installment credit helps.

- Recent credit inquiries: 10 percent. Multiple hard inquiries within a short period lower the score.

Payment history and utilization combined make up roughly 65 percent of the score, meaning everyday habits matter most. The AECB updates credit data monthly, so consistent good behavior can raise your score within a few cycles. New residents with no local history can build a profile by using secured products and paying bills on time.

How Credit Score Affects Loan Eligibility in the UAE

The AECB score is a primary indicator lenders use to assess risk, but it is one part of a holistic decision. A strong score (generally 700+) usually leads to quicker approvals, lower interest rates, and higher loan amounts. A weak score increases the likelihood of higher rates, extra scrutiny, requests for collateral, or denial.

Beyond the number, lenders analyze the full credit report to see patterns: payment consistency, utilization trends, number of accounts, historical delinquencies, and recent inquiries. Many banks also offer pre-approved products to customers with excellent scores, speeding up processing.

Salary transfer relationships matter. Borrowers who agree to transfer their salary to the lending bank often obtain higher limits or reduced rates even with a mid-range score.

Typical Minimum AECB Scores for Loan Types (2025 guidance)

- Personal loans: minimum ~650+; ideal 710+ for best rates. Some banks accept lower scores with salary transfer.

- Car loans: minimum ~670+; ideal ~700+. Vehicle is collateral so secured lending is often easier.

- Home loans: minimum ~700+; ideal ~740+ for favorable mortgage pricing. CBUAE stress tests and LTV caps apply.

- Credit cards: minimum ~650+; premium cards typically require 700+.

Every bank has its own cut-offs and may apply stricter internal policies.

How Banks Use Your Score in Loan Decisions

When you apply for credit, banks use AECB data to:

- Assess borrower risk quickly.

- Set interest rates and maximum loan amounts.

- Decide on collateral or down payment requirements.

- Apply CBUAE affordability rules, notably the Debt-Burden Ratio (DBR), which limits repayments to a percentage of income.

- Evaluate employment stability, salary transfer, and employer category.

An applicant with a 730 score, 35 percent DBR, and salary transfer is often approved rapidly. By contrast, someone with a 600 score, high utilization, multiple inquiries, and no salary transfer may be rejected or offered expensive terms.

Common Loan Rejection Reasons

Loans are commonly declined for these reasons:

- DBR above 50 percent (50 percent is the Central Bank cap for most borrowers; for pensioners it is 30 percent).

- Missed or late payments on loans, cards, or utilities.

- High credit utilization (70 percent or more causes major concern).

- Multiple recent hard inquiries indicating credit shopping.

- Unstable employment or insufficient income.

- Incomplete or inconsistent documentation.

- Bounced cheques or legal defaults recorded on the AECB report.

Addressing these areas before applying increases the chance of approval.

Key Factors Banks Consider Besides Credit Score

Lenders evaluate your full financial picture, including:

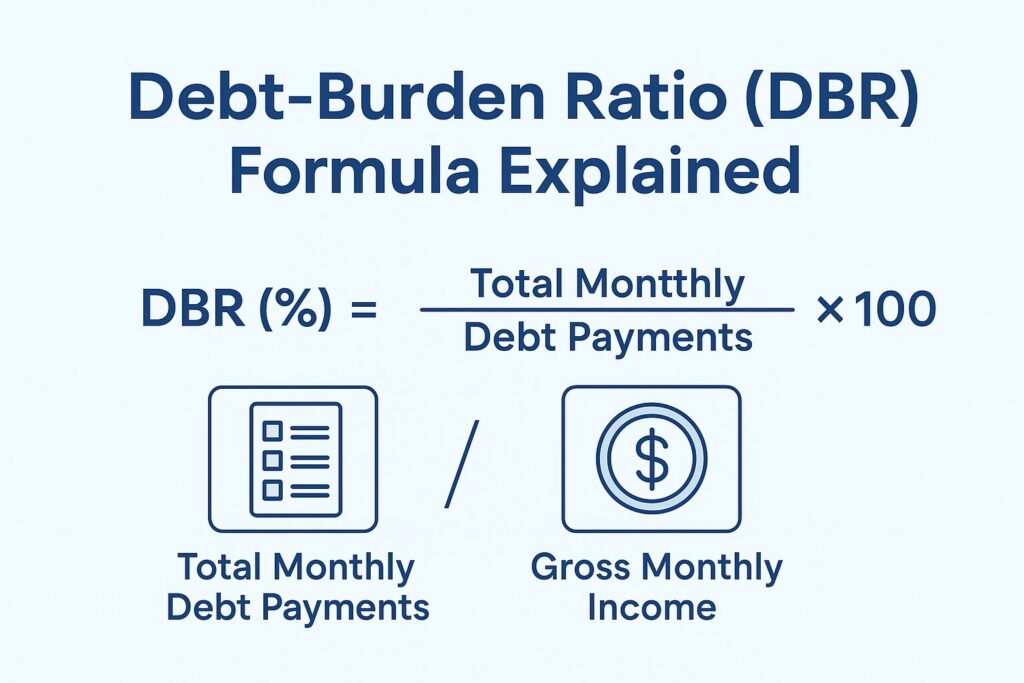

- Debt-to-Income (DTI) Ratio: Your DBR is calculated by dividing total monthly debt payments by gross monthly income. The CBUAE cap is 50 percent for most borrowers.

- Income level: Minimum salary thresholds vary by bank and product; typical personal loan thresholds range from AED 5,000 to AED 10,000.

- Employment & tenure: Longer tenure and stable employment increase approval chances. Many banks require at least 3–6 months of current employment for personal loans and 12+ months for mortgages.

- Employer category: Government and top-tier firms are viewed favorably.

- Salary transfer: Transferring salary to the lender reduces risk and often secures better pricing.

- Credit behavior: On-time payments, low utilization, limited inquiries, and a healthy credit mix.

For the self-employed, banks generally require trade licenses and 6–24 months of bank statements or audited financials.

Debt-to-Income Ratio: The Core Affordability Rule

DTI (or DBR) is central to lending in the UAE. It includes existing installments and the new loan installment. The formula is:

DTI (%) = (Total Monthly Debt Payments / Gross Monthly Income) × 100

Example: If you earn AED 10,000 and existing repayments are AED 3,000, the remaining capacity for new loans is AED 2,000 if the DBR cap is 50 percent.

Aim for a DBR below 40 percent for stronger approval odds.

Loan Eligibility: UAE Nationals vs Expats

Banks apply the same core rules but treat nationals and expatriates differently due to residency and employment risk.

For UAE Nationals

Nationals often receive more favorable terms:

- Higher borrowing limits: some banks offer personal loans up to AED 4–5 million for nationals.

- Lower interest rates: nationals frequently get rates 1–1.5 percentage points lower.

- Government-backed schemes: programs exist to consolidate debt and support lending for nationals.

- More flexible repayment terms and lower minimum salary requirements in some products.

For Expats

Expats can access most products but under stricter conditions:

- Typical AECB score expectations are higher (often 680–700+ for preferred terms).

- Minimum salary requirements tend to start around AED 7,000–10,000 depending on lender.

- Loan amounts are generally lower than for nationals; many banks cap personal loans for expats around AED 2–3 million.

- Documentation requirements include passport, Emirates ID, valid visa, salary certificate, and bank statements.

- Tenure and visa validity are checked; loans should conclude before a borrower reaches certain age limits set by banks.

Salary transfer remains a major boost for expat applicants.

Salary Transfer Advantage

Salary transfer to the lending bank reduces default risk because repayments can be directly debited. Benefits include:

- Lower interest rates, commonly 0.5–1 percent better than non-transfer loans.

- Higher loan multiples, sometimes up to 20x monthly salary.

- Faster approvals and pre-approved offers for current customers.

- Automated repayments that protect your AECB score by reducing the chance of missed EMIs.

Non-salary transfer products exist, but they usually carry higher rates and stricter terms.

How to Improve Your Credit Score Before Applying

The AECB score is not fixed. It updates monthly and responds to consistent behavior. Practical steps:

- Pay all bills on time. Payment history is approximately 35 percent of your score. Set up auto-pay and calendar reminders. Even small dormant balances should be cleared.

- Keep credit utilization below 30 percent. Pay down balances, make payments before statement date, and request limit increases only if you can avoid higher spending.

- Avoid multiple applications. Each hard inquiry can lower your score. Use pre-approval tools and wait 3–6 months between applications.

- Check and correct your AECB report. Obtain your report from AECB or via DubaiNow/TAMM, and use the Data Correction service to dispute errors. The bureau typically resolves issues within 10 working days.

- Keep older accounts open. Account age contributes positively to your score.

- Use secured credit products to build history if you are new to the UAE. Secured cards require a deposit and help establish a payment record.

Small improvements can appear within two to three billing cycles. Large changes typically take six to twelve months of disciplined behavior.

Practical Preparation Before Applying

- Calculate your DBR accurately, including all card minimum payments.

- Check your AECB report and dispute any errors.

- Reduce credit card balances and avoid opening new credit shortly before applying.

- Gather employer documents, salary certificates, and recent bank statements.

- Consider salary transfer to improve terms.

FAQs

- What is a good credit score in the UAE?

A score above 700 is generally considered good; 740+ is better for top mortgage offers. - Can I get a loan with a bad score?

Yes, but expect higher rates, collateral, guarantors, salary transfer requirements, or denial. - How can new residents build credit?

Open a salary account, use a secured credit card, and pay utility/telecom bills on time. Your first AECB score appears after a few months of local activity. - How long to improve the score?

Noticeable changes in 2–3 months with focused action; major improvements in 6–12 months. - How to check the AECB report?

AECB website or app, DubaiNow, TAMM. Fees: AED 10.50 (score) or AED 84 (full report). - What is the DTI limit?

CBUAE caps DBR at 50 percent for most borrowers, 30 percent for pensioners.

Final Thoughts

Your AECB credit score is the gateway to better loan terms, faster approvals, and greater financial options in the UAE. In 2025, with stronger regulatory focus from the Central Bank, maintaining a strong profile is essential. Focus on timely payments, low utilization, limited hard inquiries, and regular monitoring. If you need finance, check your AECB report first, correct any errors, reduce debts where possible, and consider salary transfer as a practical step to improve eligibility.

Omar Hassan, your trusted guide to navigating the UAE banking landscape. With over 15 years of experience in the industry and a Master’s degree in Finance, Omar leverages his expertise to provide clear and insightful information on balance checking methods, bank comparisons, and financial management tips for UAE residents.