Best Mobile Wallets and Digital Payment Apps in UAE (2025)

Mobile wallets are transforming how people pay and transfer money in the UAE. In 2025, residents, expats, and visitors increasingly rely on digital apps to tap, scan, or send payments instantly — no cash or cards required. These wallets store your bank cards securely, use NFC or QR codes, and connect with UAE banks and services for seamless spending.

This guide compares the best mobile wallets UAE users trust including Apple Pay, Google Pay, Samsung Wallet, Careem Pay, PayBy, Payit, and Beam. You’ll learn how each works, their unique benefits, and which fits your daily needs best.

We’ll also explore mobile wallet security, setup steps, and key 2025 trends — from Tap-to-Pay adoption and Central Bank initiatives like Aani and Jaywan, to the rise of super-apps and digital remittance tools.

What are mobile wallets and how do they work in the UAE

A mobile wallet is a secure smartphone app that stores debit and credit cards, loyalty cards and payment credentials. It replaces your physical wallet and lets you make fast, contactless payments with a phone or smartwatch.

In the UAE, mobile wallets are central to digital banking and cashless payments. Backed by the Central Bank of the UAE (CBUAE), these apps make it easier for residents, expats and tourists to pay everyday needs — from groceries and taxis to online shopping and bills. Popular apps include Apple Pay, Google Pay, Samsung Wallet and local options like PayBy, Payit and Careem Pay. Most major UAE banks support these wallets.

How mobile wallets work in the UAE

- Add your card. Download the app and add a debit or credit card. The bank and CBUAE verify details.

- Authenticate. Transactions are confirmed with biometric authentication or a PIN.

- Tokenization. Wallets replace real card numbers with single-use tokens during payments. Merchants never see your card data.

- Contactless NFC. Tap your phone at a compatible terminal for instant payments.

- QR payments. Local wallets support QR codes, popular with small retailers and cafés.

- Online and in-app payments. Choose the wallet at checkout, confirm with biometrics, and complete payment without entering card numbers.

- Real-time confirmations. Users and merchants receive instant notifications, and the app records transactions for tracking.

Benefits of mobile wallets in the UAE

Mobile wallets combine speed, security and convenience. They help residents, expats and visitors manage payments without cash or cards.

- Fast and contactless payments

Tap-and-go checkout completes purchases in seconds using NFC or QR code. Wallets store cards, loyalty points and tickets in one app. Instant transfers are possible through Aani, the UAE’s real-time payment platform. - Enhanced security and fraud protection

UAE wallets use tokenization, biometric verification and encryption under CBUAE frameworks. Cards can be disabled remotely if a phone is lost. Tokenization and one-time codes reduce fraud risk. - Rewards, cashback and loyalty

Many wallets offer cashback, loyalty points and geo-based promotions. Some allow stacking rewards from both the card provider and the wallet app. - Easy remittances and financial access

For the expatriate community, wallets simplify sending money abroad. Platforms like Careem Pay and Payit provide low-fee remittances. Wallets can also receive salary payments and pay utility bills, improving financial inclusion. - Smarter budgeting and expense tracking

Wallets give real-time notifications and transaction categorization, helping users track spending and detect unusual activity. - Cross-platform support and 24/7 access

Wallets work across iPhone, Android and wearables and link with banks such as Emirates NBD, FAB, Mashreq and RAKBANK for round-the-clock access. - Supporting the UAE’s cashless future

National platforms like Aani (instant payments) and Jaywan (domestic card scheme) make transactions faster, cheaper and more secure.

Best mobile wallets and apps in the UAE (2025)

The UAE is one of the world’s most advanced digital payment markets. In 2025, wallets are the new norm. The CBUAE supports this transformation with Aani and Jaywan, making wallets safer, faster and interoperable across banks.

Key wallets and what they offer

Apple Pay

- Origin: Apple

- Features: Tap-to-Pay via NFC, tokenization, biometric authentication

- Banks: Emirates NBD, ADCB, Mashreq, FAB, HSBC, RAKBANK, Emirates Islamic

- Strengths: Fast, secure, wide acceptance on iOS. Apple Watch integration.

- Limitations: Only on Apple devices.

Google Pay

- Origin: Google

- Features: NFC and QR payments, loyalty cards, boarding passes

- Strengths: Broad Android compatibility, simple UI. Stores tickets and passes.

- Limitations: Fewer cashback offers.

Samsung Wallet

- Origin: Samsung

- Features: NFC, MST for older POS, digital loyalty cards, P2P transfers

- Strengths: Works with older terminals, integrates Samsung Rewards.

- Limitations: Samsung devices only.

Payit (FAB)

- Origin: Bank-backed by First Abu Dhabi Bank

- Features: Salary deposits, bill payments, remittance, Payit Plus

- Strengths: Bank-grade security, no minimum balance or FAB account required.

- Limits: AED 25,000/month wallet limit.

Careem Pay

- Origin: Careem Super App

- Features: Bill payments, P2P transfers, international remittances

- Strengths: Integrated with Careem services, ideal for expats and frequent users.

- Limitations: Merchant coverage as standalone wallet is still expanding.

PayBy

- Origin: Local fintech

- Features: QR payments, eKYC via Emirates ID, bill splitting

- Strengths: Accepted at LuLu, ADNOC and partner retailers.

- Limitations: No NFC support.

Beam Wallet

- Origin: Startup

- Features: Cashback, loyalty rewards, beacon fuel payments

- Strengths: High cashback rates and retail perks.

- Limitations: Limited use outside partner retailers.

Klip

- Origin: Consortium-backed

- Features: Simple digital payments, low-fee transfers

- Strengths: Low fees and user-friendly.

- Limitations: Limited rewards.

Best wallet by user type

- iPhone users: Apple Pay

- Android users: Google Pay / Samsung Wallet

- Salaried workers: Payit

- Frequent remitters: Careem Pay / Payit

- Everyday shoppers: PayBy / Beam

- Telecom users: e& Money

- No-fee users: Klip

Security and regulatory oversight

All UAE wallets operate under the CBUAE’s Stored Value Facilities framework. Key protections include:

- Tokenization so merchants never see card numbers

- Biometric verification for transactions

- Encryption of user data

- Instant card blocking and remote wallet disabling

- AI-based fraud detection

These rules and technologies make the UAE one of the most secure digital payment markets globally.

Careem Pay (example deep-dive)

Careem Pay is embedded in the Careem Super App and licensed by the CBUAE. It offers:

- Peer transfers using phone numbers

- Low-fee international remittances to many countries

- Bill payments and QR code payments

- Biometric and PIN security

- Integration with FAB and Mastercard Send

Careem Pay is best for expats and users who already use Careem services frequently.

Apple Pay and Tap to Pay in the UAE

Apple Pay provides secure contactless payments on iPhone and Apple Watch. In December 2024, Apple launched Tap to Pay in the UAE, allowing merchants to accept contactless payments directly on iPhones without extra hardware. Apple Pay uses tokenization and biometric verification and is supported by major UAE banks.

Google Pay and Samsung Pay

Google Pay and Samsung Wallet lead Android payments. Google Pay works on Android 7.0+ and Wear OS, stores cards and tickets, and supports NFC and QR payments. Samsung Wallet uses NFC and MST, supports Samsung Rewards, and relies on Samsung security features.

PayBy, Payit, Beam Wallet

Local fintechs drive wallet adoption with features tailored to UAE needs.

PayBy

- QR payments, eKYC via Emirates ID, accepted at large retailers and cafes.

- Good for quick retail payments.

Payit (FAB)

- Bank-backed wallet with salary and bill features.

- No FAB account required; integrates government and utility payments.

- Wallet limits depend on verification.

Beam Wallet

- Cashback and beacon-based payments for fuel and retail.

- Exploring blockchain for loyalty features.

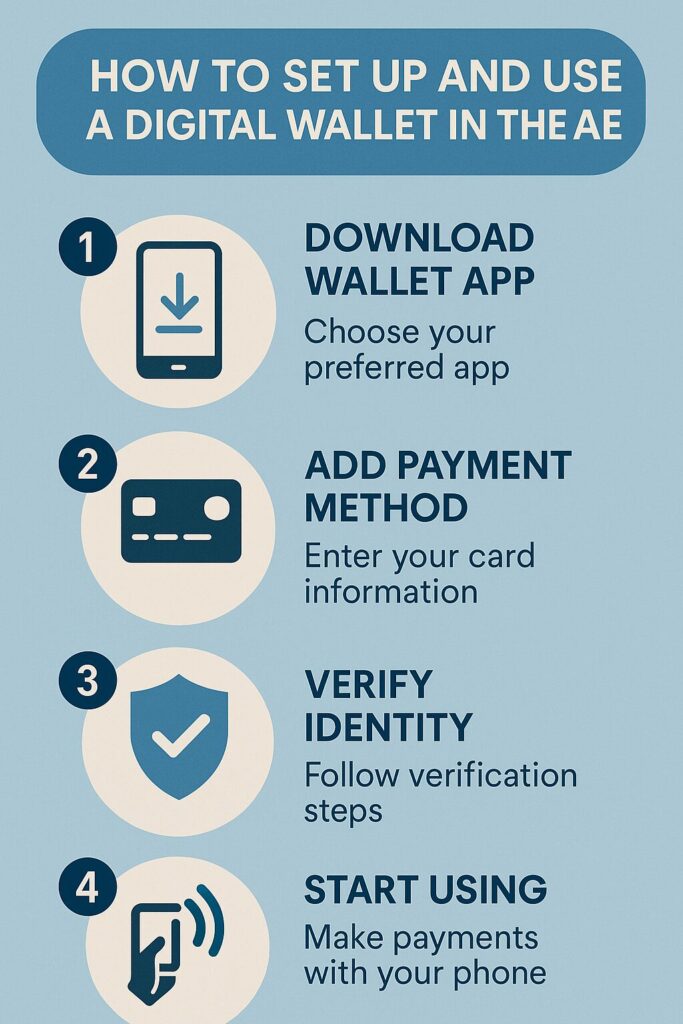

How to set up and use a digital wallet in the UAE

Setting up a wallet takes minutes. Steps:

- Download the app from the App Store or Google Play.

- Verify device compatibility (iPhone 6+ for Apple Pay; Android 7.0+ for Google Wallet).

- Register and verify identity using Emirates ID or passport (eKYC).

- Add a debit or credit card and confirm via OTP or bank app.

- Enable biometrics or PIN.

- Start paying: tap for NFC, scan QR codes for supported wallets, or choose wallet at online checkout.

- Track transactions in-app and enable notifications.

Transaction limits vary by wallet and verification level. For example, some local wallets list daily and monthly caps; bank-issued cards follow bank policies.

Security tips:

- Enable biometrics and two-factor authentication.

- Avoid public Wi-Fi for transactions.

- Keep apps and OS updated.

- Monitor account activity and enable alerts.

- Remotely disable a wallet if the device is lost.

The rise of contactless payments in the UAE

Government support and consumer trust have driven rapid adoption. Key drivers:

- Aani Instant Payment Platform enables instant transfers.

- Jaywan Domestic Card Scheme supports local payment routing.

- Contactless usage is widespread across retail, transport and public services.

- Tap-to-Phone and QR code payments bring acceptance to small merchants.

Contactless payments are mainstream in transport, fuel, government services, and retail. Market projections show rapid growth and high weekly usage of mobile wallets.

Are digital wallets safe?

Yes. Wallets in the UAE are protected by encryption, tokenization, biometric controls and CBUAE regulation. Additional safeguards include AI fraud detection and data protection laws. Laws such as Federal Decree Law No. 34 (cybercrime) and Federal Decree Law No. 45 (data protection) strengthen legal protections.

User best practices:

- Use strong unique passwords.

- Enable biometric login and two-factor authentication.

- Avoid public Wi-Fi for payments.

- Watch for phishing and never share OTPs.

- Monitor transactions regularly.

Future of digital payments in the UAE (2025–2030)

The UAE is positioning itself as a fintech leader. Major trends include:

- Digital Dirham (CBDC)

The Digital Dirham will enable instant settlements, improve traceability and support inclusion. It will work with regulated wallets. - AI and machine learning

AI will improve fraud detection, personalize financial advice and enable conversational payments. - Open banking and real-time payments

Open Finance will let fintechs and banks share data with consent, enabling unified dashboards and faster cross-bank transactions. Aani already supports 24/7 interbank transfers. - Tap-to-Phone and BNPL

Tap-to-Phone expands acceptance without hardware. BNPL services are expected to integrate with wallets for smoother checkout financing. - IoT and wearables

Payments will move into wearables, vehicles and smart devices. Retailers and fuel networks are piloting auto-pay and beacon-based payments. - Vision 2031 goals

By 2030, the UAE aims for near-complete digital transaction adoption, full AI and blockchain integration, and a leading fintech ecosystem.

Final thoughts

The UAE’s move to digital-first payments is reshaping everyday finance. From global players like Apple Pay and Google Pay to local wallets such as Payit and Careem Pay, users enjoy speed, security and rewards. With strong regulation, AI-driven security and national initiatives like Aani and Jaywan, wallets are a secure and practical choice for residents, expats and visitors.

Why it matters:

- Security through encryption, tokenization and CBUAE regulation.

- Convenience to pay, transfer and track money instantly.

- Inclusion for people with limited banking access.

- Innovation as the foundation for future payments.

Omar Hassan, your trusted guide to navigating the UAE banking landscape. With over 15 years of experience in the industry and a Master’s degree in Finance, Omar leverages his expertise to provide clear and insightful information on balance checking methods, bank comparisons, and financial management tips for UAE residents.