Best UAE Credit Cards for 2025: Top Offers for Cashback, Rewards & Zero Interest

Finding the best UAE credit cards in 2025 can help you unlock valuable rewards, exclusive travel perks, and smarter financial control. With dozens of banks offering cashback, rewards, and 0% interest credit cards, choosing the right one depends on your lifestyle and spending habits. Whether you want to earn cashback on groceries and dining, collect air miles for your next trip, or enjoy flexible balance transfer plans, this guide highlights the best UAE credit cards and top offers for every need.

You’ll also learn how to compare annual fees, minimum salary requirements, and reward limits to ensure maximum value. From Emirates NBD’s Skywards cards to Mashreq’s free-for-life cashback options and FAB’s low-interest plans, we’ve rounded up the best credit cards in the UAE that combine convenience, savings, and exclusive privileges.

Compare, choose, and apply for the best UAE credit card today to make every purchase more rewarding and financially efficient.

What Are the Best Credit Cards in the UAE and How Do They Work?

Credit cards in the UAE are powerful financial tools that offer flexibility, convenience, and rewards when used responsibly. They allow users to make purchases or withdraw cash up to a pre-set credit limit, with repayment due each billing cycle. Paying the full balance by the due date ensures you enjoy interest-free days typically between 21 and 57 days while carrying a balance leads to interest charges ranging from 1.5% to 3.5% per month. To avoid unnecessary costs, always pay your balance in full and on time.

Different credit cards cater to various lifestyles and income levels. For instance, the Emirates NBD Lulu 247 Titanium Card offers up to 3.5% LuLu points on groceries and daily spending with no annual fee. The Mashreq Cashback Card and Liv Cashback Card reward users with 5–6% cashback on dining, online shopping, and fuel. Frequent travellers prefer the Emirates Islamic Skywards Credit Card, which earns up to 2 miles per USD along with lounge access and travel insurance. If you’re seeking affordability, the FAB Low-Rate Credit Card features one of the lowest interest rates in the UAE starting from 1.99% monthly, while the Citi Simplicity Card eliminates all annual and late payment fees.

Eligibility typically starts at AED 5,000 monthly income and requires UAE residency, Emirates ID, and valid identification documents. Responsible usage builds your AECB credit score, improving future loan and mortgage opportunities. Whether you’re aiming for cashback, travel rewards, or 0% balance transfer plans, choosing the right UAE credit card can enhance your financial flexibility, making every purchase more rewarding.

How to Choose the Right Credit Card for Your Needs in the UAE

Choosing the right credit card in the UAE depends on how and where you spend. If most of your budget goes to groceries or fuel, a cashback card like Mashreq Cashback or Emirates NBD Lulu 247 Titanium (up to 3.5% cashback) offers excellent value. Frequent travelers should consider Emirates Islamic Skywards or FAB Etihad Guest cards for air miles, lounge access, and travel insurance. If you prefer flexibility, 0% interest or balance transfer cards such as FAB Low-Rate or HSBC Zero Credit Card are great for managing larger expenses.

Before applying, review your monthly income, annual fees, and interest rates. Most UAE cards require a minimum salary of AED 5,000, with premium cards starting around AED 15,000. Always ensure the rewards outweigh any fees and check the Key Facts Statement for hidden charges.

To simplify your search, use our UAE Credit Card Comparison Tool to filter cards by rewards, benefits, and eligibility helping you find the perfect match for your lifestyle.

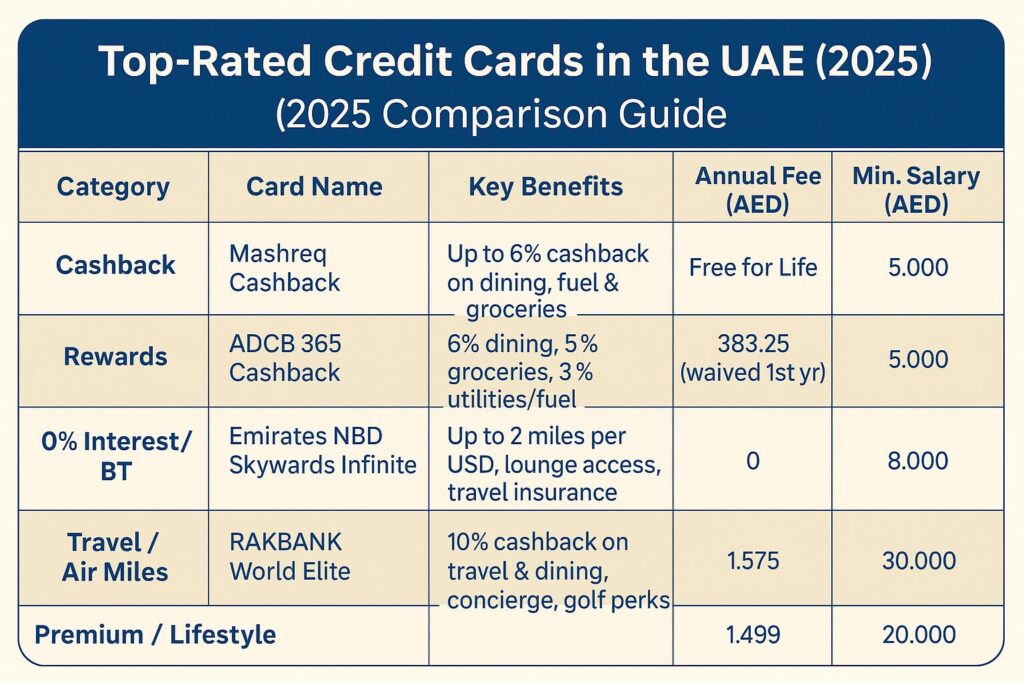

Top-Rated Credit Cards in the UAE (2025 Comparison Guide)

The best credit cards in the UAE for 2025 cater to diverse lifestyles — from cashback seekers to frequent travelers and smart spenders managing large purchases. Choosing the right card helps you maximize savings, earn valuable rewards, and enjoy premium perks like airport lounge access or 0% installment plans. Below is a quick comparison of the top-performing UAE credit cards by category, making it easier to find one that fits your goals.

Use our Credit Card Comparison Tool to filter by salary, features, or benefits and apply online for your preferred card instantly.

Best Cashback and Rewards Credit Cards

Cashback and rewards cards are perfect for everyday expenses such as groceries, fuel, and dining. The Mashreq Cashback Card offers up to 6% cashback on key categories with no annual fee, while the Emirates NBD Lulu 247 Titanium provides 3.5% back in LuLu points for supermarket purchases. For tiered earning, the ADCB 365 Cashback Card gives 6% on dining and 5% on groceries, while Citi Cashback and HSBC Live+ reward international and local spending with 1–6% cashback.

To maximize earnings, use your card for its bonus categories, pay your balance in full each month, and redeem rewards regularly through your bank’s app or portal. Cashback can often be applied directly to your statement or exchanged for vouchers.

Explore UAE cashback promotions now to find the best offers and apply online for a card that matches your spending style

Best 0% Interest and Balance Transfer Credit Cards

If you’re managing debt or planning major purchases, 0% interest and balance transfer cards can help reduce costs. The HSBC Zero Credit Card provides 0% interest on purchases for up to 6 months, while RAKBANK’s Balance Transfer Offer gives 3 months interest-free with a low 1.95% processing fee. CBI Options cards extend up to 6 months of 0% interest, and Emirates NBD offers flexible 0% installment plans on large purchases.

These cards are ideal for short-term financing or consolidating balances, helping you save on high interest rates. Compare tenure, processing fees, and transfer limits before applying to ensure the best deal.

Check 0% balance transfer and installment offers from UAE banks today to manage payments more efficiently.

Best Travel and Air Miles Credit Cards

For frequent flyers, travel and air miles cards unlock luxury experiences and long-term savings. The Emirates NBD Skywards Infinite and Emirates Islamic Skywards Infinite cards offer up to 2 Skywards Miles per USD spent, lounge access, and comprehensive travel insurance. The ADCB Traveller Credit Card gives 10% cashback on airline tickets and hotel stays, while RAKBANK Emirates Skywards World Elite includes automatic Silver status and unlimited lounge access.

Many of these cards partner with Emirates Skywards or Etihad Guest, allowing you to redeem miles for free flights, upgrades, or travel perks. While they come with higher income requirements (from AED 15,000–30,000), the rewards and privileges often outweigh the fees for regular travelers.

Apply for a UAE travel credit card before your next trip to earn miles faster and travel in comfort with exclusive premium benefits.

What Are the Eligibility and Requirements for Getting a Credit Card in the UAE?

To apply for a credit card in the UAE, you must meet the eligibility standards set by the Central Bank of the UAE (CBUAE) and individual bank policies. Applicants must be at least 21 years old, a UAE resident or national, and earn a minimum monthly salary of AED 5,000. Some high-tier or travel cards may require a higher income, often between AED 15,000 and AED 30,000. Banks also assess your credit score through the Al Etihad Credit Bureau (AECB) — a score above 700 improves approval chances and can qualify you for better rewards or credit limits.

Your Debt Burden Ratio (DBR) must not exceed 50% of your gross monthly income, ensuring that all active debts remain manageable. In some cases, banks issue supplementary cards for dependents aged 18 and above, and occasionally as young as 12 for family-linked accounts.

To complete the application, the following documents are typically required:

- Valid Emirates ID (original and copy)

- Passport with UAE residence visa page

- Salary certificate or payslip (for employees)

- Trade license and bank statements (3–6 months) for self-employed applicants

- Proof of address (utility bill or tenancy contract, if requested)

- Security cheque or deposit (optional, for applicants near the minimum salary threshold)

If you don’t meet income or credit score requirements, consider a secured credit card, which requires a refundable fixed deposit. It’s an excellent way to build your credit history and qualify for standard cards later

How to Apply for a Credit Card Online in the UAE

Applying for a credit card online in the UAE is fast, secure, and completely digital, with most banks offering instant or same-day approvals. Whether you’re seeking cashback, travel perks, or 0% balance transfer plans, the online process is designed to be convenient and paperless.

Step-by-Step Online Application Process:

- Compare and Select a Card: Use a reliable credit card comparison tool or visit the official websites of leading banks like Emirates NBD, ADCB, FAB, HSBC, or Mashreq. Choose a card that fits your lifestyle cashback for shoppers, air miles for travelers, or low-interest cards for balance transfers.

- Check Eligibility: Confirm that you meet the age (21+ years), UAE residency, and minimum income requirement (usually AED 5,000/month). Premium cards may require higher salaries.

- Prepare Digital Documents: Keep soft copies of your Emirates ID, passport with visa page, salary certificate, and 3–6 months of bank statements ready for upload. Some banks may also ask for a security cheque or proof of address.

- Complete the Online Form: Enter personal, employment, and income details through the bank’s website or app, then upload your documents.

- Verification and Approval: The bank reviews your credit score via the Al Etihad Credit Bureau (AECB) and verifies your information. Instant approvals are common with digital-first banks like Liv and Mashreq Neo.

- Receive Your Card: Once approved, you’ll receive your virtual card instantly or a physical card within 3–5 business days.

Which Banks Offer the Best Credit Cards in the UAE?

Several leading banks in the UAE provide competitive credit card options designed for different spending profiles whether you prioritize cashback, travel, or low-interest financing. Below is a quick overview of the top banks and their standout features for 2025:

- Emirates NBD: The UAE’s largest retail bank offering popular options like Lulu 247 Titanium (for groceries) and Skywards Infinite (for travel). Known for fast online approvals, 0% installment plans, and strong digital banking features.

- Mashreq Bank: Ideal for expats and online shoppers. The Mashreq Cashback Card provides up to 6% cashback, while Mashreq Neo offers instant digital approvals and no annual fees.

- First Abu Dhabi Bank (FAB): Offers low-interest and Etihad Guest cards, such as the FAB Low-Rate (from 1.99% monthly) and Etihad Guest Platinum, combining flexible rewards with solid financing options.

- ADCB (Abu Dhabi Commercial Bank): Known for 365 Cashback and Talabat co-branded cards, offering up to 6% cashback and excellent TouchPoints reward programs with fast, paperless onboarding.

- HSBC UAE: Strong global bank for expats, featuring the HSBC Zero and HSBC Live+ cards with 0% interest offers, premium dining and travel discounts, and free airport lounge access.

- Emirates Islamic: A top choice for Shariah-compliant credit cards, especially the Skywards Islamic Card, offering air miles, travel perks, and profit-based financing instead of interest.

- RAKBANK: Focuses on high-value cashback cards like the RAKBANK World Elite, offering up to 10% cashback on dining and travel, with concierge and golf privileges.

- Citibank: Known for simplicity and transparency. The Citi Simplicity Card has no annual, late payment, or over-limit fees, making it one of the most user-friendly credit cards in the UAE.

Each of these banks offers regular welcome bonuses, cashback boosts, and seasonal promotions, especially during major events like Ramadan or Dubai Shopping Festival.

What Are the Latest Credit Card Promotions and Offers in the UAE?

As of October 2025, UAE banks are offering exciting limited-time credit card promotions with cashback boosts, travel perks, and lifestyle rewards. RAKBANK World Credit Card gives an AED 750 welcome bonus plus 10% cashback on dining, travel, and groceries. FAB Cashback Card offers a free family staycation at Rixos Bab Al Bahr when you spend AED 10,000 within 60 days. HSBC provides an AED 800 Amazon gift card and AED 100 cashback for mobile wallet use. Emirates NBD features 50% off dining, entertainment discounts, and special Skywards Miles bonuses, while ADCB Talabat Card rewards 35% cashback and free deliveries. New Mashreq Cashback Card users earn AED 500 upon spending AED 5,000.

These deals are valid for a short time only, often expiring within 60–90 days. Apply now through official bank websites to claim your welcome bonuses and seasonal cashback offers before they end.

How to Manage and Maximize Credit Card Benefits in the UAE

Managing your credit cards wisely ensures you gain the full rewards without falling into debt. The key is consistency pay on time, track spending, and use the right card for each purchase. Always pay your full balance each month to avoid high interest (2.5%–3.5% monthly) and protect your AECB credit score. Setting up auto-payments guarantees you never miss a due date.

Keep your credit utilization below 30% and review your statements monthly to detect unauthorized transactions early. For maximum value, match your cards to your spending habits use a cashback card for groceries, a travel card for flights, and a lifestyle card for dining or entertainment. Take advantage of partner deals, like 2-for-1 dining via The Entertainer or movie discounts at VOX and Reel Cinemas.

Plan large purchases strategically to meet welcome bonus criteria and redeem rewards before expiry. Stay informed, use multiple cards smartly, and check our UAE Credit Score Guide to keep your financial profile strong

Frequently Asked Questions About Credit Cards in the UAE

1. Can expatriates apply for a credit card in the UAE?

Yes. Expats can easily apply for a UAE credit card as long as they have a valid residence visa, Emirates ID, and meet the minimum salary requirement (usually AED 5,000 per month). Most banks welcome expat applicants and offer cards tailored for international use.

2. What is the minimum salary required for approval?

The Central Bank of the UAE mandates a minimum income of AED 5,000 monthly (or AED 60,000 annually). Premium or travel cards typically require higher salaries, ranging from AED 15,000 to AED 30,000 depending on the card tier and benefits.

3. Do I need a credit history to get a card?

Not necessarily. First-time applicants can qualify for entry-level or secured credit cards, which require a refundable deposit. Over time, responsible usage helps build a strong AECB credit score for better future approvals.

4. What happens if I miss a payment?

Missing a payment triggers late fees (AED 150–300) and monthly interest (2.5%–3.5%) on the outstanding balance. It also negatively impacts your credit score, making future loans harder to obtain.

5. Are there annual fees?

Many cards are “free for life” or waive annual fees for the first year. However, premium cards with air miles or luxury perks may charge fees, so always compare the benefits versus costs before applying.

6. Can I withdraw cash using my credit card?

Yes, but only when necessary. Cash advances incur high fees (about 3–4% of the withdrawn amount) and interest starts immediately—there’s no grace period.

7. What types of rewards are available?

UAE cards offer diverse rewards like cashback, air miles (Emirates Skywards, Etihad Guest), shopping points, and lifestyle perks such as airport lounge access, 2-for-1 dining, and valet parking.

Final Thoughts Finding the Best Credit Card for Your Lifestyle

The best credit card in the UAE isn’t about the highest rewards — it’s about finding the one that fits your lifestyle, spending habits, and financial discipline. If your expenses go mostly toward groceries, fuel, or daily shopping, a cashback card like Emirates NBD Lulu 247 delivers steady savings. For frequent travelers, air miles cards such as Emirates Islamic Skywards Infinite or FAB Etihad Guest turn your purchases into flight upgrades and exclusive travel perks.

Always read the fine print before applying. Check annual fees, reward caps, and post-promotional rates. A “free-for-life” card is often more cost-effective than a premium one with high fees you can’t fully utilize. Likewise, use 0% balance transfer or installment offers wisely to manage large purchases without interest. Above all, maintain financial discipline by paying your balance in full each month to avoid interest and keep your AECB credit score strong.

Omar Hassan, your trusted guide to navigating the UAE banking landscape. With over 15 years of experience in the industry and a Master’s degree in Finance, Omar leverages his expertise to provide clear and insightful information on balance checking methods, bank comparisons, and financial management tips for UAE residents.