How to Do a Salary Card Balance Check in the UAE (2025 Guide)

Millions of employees across the UAE receive their wages through salary cards every month. These prepaid cards are part of the Wage Protection System (WPS) — a government-regulated program that ensures every worker is paid securely, on time, and through authorized banking channels.

Performing a regular salary card balance check helps you confirm that your salary has been credited correctly and that no unexpected deductions occurred. Many workers in Dubai, Abu Dhabi, and Sharjah rely on quick balance checks to plan expenses, send remittances, and avoid declined transactions at ATMs.

Imagine it’s payday before paying bills or transferring money home, you can instantly verify your wages on your FAB Ratibi, RAKBANK Payroll, or Al Ansari PayPlus card. With just a few taps on a mobile app, an ATM inquiry, or through the official WPS portal, you’ll know your exact balance in seconds..

What Is a Salary Card in the UAE?

A salary card is a prepaid, reloadable debit card that allows employees in the UAE to receive their monthly wages without needing a traditional bank account. It forms a key part of the Wage Protection System (WPS), regulated by the UAE Central Bank and the Ministry of Human Resources and Emiratisation (MOHRE).

Employers use approved banks or exchange houses to issue salary cards and credit salaries electronically each month. The system helps ensure timely, secure, and traceable wage payments, especially for expatriate and low-income workers.

Employees can withdraw cash, shop, or send remittances through ATMs and point-of-sale terminals across the UAE. While these cards often have minimal fees, small charges may apply for off-network ATM use.

Salary cards promote wage transparency and financial inclusion. Learn how employers register for compliance in the WPS Registration Guide for UAE Employers.

Understanding WPS and Payroll Cards

The Wage Protection System (WPS) is a mandatory electronic platform that ensures private-sector employees are paid accurately and on time. It is jointly overseen by MOHRE and the UAE Central Bank, covering every registered employer in the country.

Here’s how it works: companies submit a digital Salary Information File (SIF) through their bank or exchange house. Once approved, salaries are automatically transferred to each worker’s WPS-compliant payroll card.

This creates a government-verified record of every wage payment, helping prevent late or partial salary transfers. For workers, it means guaranteed access to funds and proof of payment; for employers, it simplifies payroll tracking and protects against compliance penalties.

Payroll cards connect the WPS database with the employee’s everyday finances turning verified salary deposits into instantly usable money for cash withdrawals, purchases, or remittance transfers.

Difference Between a Salary Card and a Salary Account

Both salary cards and salary accounts are used to receive wages, but they cater to different financial needs. A salary card is a prepaid payroll solution issued through an employer’s WPS partner, while a salary account is a full bank account managed by the employee.

Salary cards are best suited for employees earning up to AED 5,000 or those not eligible for regular accounts. They support withdrawals, in-store purchases, and digital transfers but do not provide overdrafts or credit. Salary accounts, however, offer loans, savings, and investment products but may require a minimum salary transfer.

| Feature | Salary Card | Salary Account |

| Type | Prepaid payroll card | Full bank account |

| Eligibility | Low-income or unbanked workers | Salaried professionals |

| Credit Access | Not available | Available |

| Regulation | WPS / MOHRE | Standard banking rules |

Compare account options in the Best Salary Accounts in UAE guide.

Why You Should Regularly Check Your Salary Card Balance

Regularly checking your salary card balance is one of the most effective ways to stay financially secure in the UAE. Since salary cards are prepaid and not full bank accounts, they require extra attention to ensure your wages are loaded correctly and that no unauthorized deductions occur.

Each balance check helps you confirm salary payments made through the Wage Protection System (WPS). Most providers, like FAB and Al Rostamani, send free SMS alerts whenever a salary is credited—making it easy to verify on time. Regular checks also help you avoid overspending, since salary cards don’t offer overdraft facilities.

Monitoring your balance helps you plan remittances or bill payments confidently, knowing your available funds. It also helps you avoid hidden fees, such as charges for using another bank’s ATM or for account inactivity.

For security, reviewing your transaction history helps detect fraud or merchant errors early, allowing you to dispute incorrect charges quickly

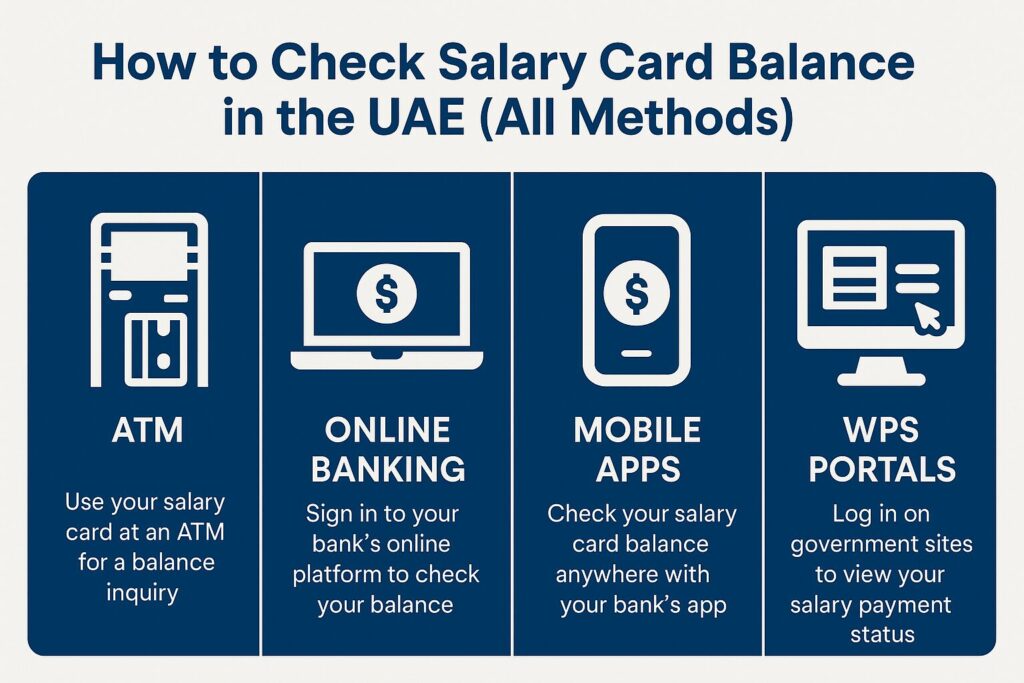

How to Check Salary Card Balance in the UAE (All Methods)

There are several reliable ways to check your salary card balance in the UAE. Whether you prefer using a mobile app, ATM, website, or SMS, each option connects securely to your bank or WPS card provider for instant updates.

These tools work for major providers like FAB Ratibi, Al Ansari PayPlus, Al Rostamani RPay, RAKBANK Payroll, and Edenred C3Pay. Each platform is designed to help you confirm salary credits, track transactions, and manage spending without visiting a branch.

Here’s a quick overview of the main balance inquiry options:

| Method | How It Works | Best For |

| Mobile App | Use your provider’s app for instant access | Fastest, most convenient |

| ATM | Insert your card → PIN → Balance Inquiry | Offline users |

| Website Portal | Enter card details on official site | Desktop or mobile browser |

| SMS / Helpline | Send code or call provider for updates | No internet access |

| MOHRE Portal | Verify salary credit through WPS system | Payment confirmation |

Each method gives you secure access to real-time balance data. Always use official links or apps from your provider to protect your card credentials.

Online via Bank Website

Many UAE banks and exchange houses offer secure online balance portals for their salary cards. For example, FAB Ratibi users can visit fabcheckbalance.com, while C3Pay and Al Ansari PayPlus cardholders have dedicated inquiry pages.

To check online:

- Visit your provider’s official balance inquiry portal.

- Enter your card ID and last few digits of your card.

- Complete the security captcha and click “Go.”

Your available balance and recent transactions appear instantly—no full banking login required. This method works on both desktop and mobile browsers, offering quick access without downloading an app.

Salary Card Balance Inquiry Through Mobile App

The mobile app is the fastest way to check your salary card balance anytime, anywhere. Providers like FAB (Payit), Al Ansari (PayPlus), Al Rostamani (RPay), and Edenred (C3Pay) offer user-friendly apps for both Android and iOS.

To use:

- Download your card provider’s official app from Google Play or the App Store.

- Register using your salary card number and Emirates ID.

- Log in to view your balance, salary credits, and transaction history.

These apps also let you enable real-time alerts for salary deposits and purchases, helping you monitor spending closely.

The app method is ideal for on-the-go employees who prefer 24/7 control and instant notifications.

Explore recommended apps at Top Banking Apps in the UAE.

Check via ATM

For a quick offline option, you can check your salary card balance at any ATM that supports your card’s network (Visa or Mastercard).

Follow these steps:

- Insert your card into the ATM and enter your PIN.

- Choose “Balance Inquiry” from the main menu.

- View the displayed amount or print a receipt.

Balance checks are free at your provider’s own ATMs (e.g., FAB ATMs for Ratibi cards). Using another bank’s ATM may result in a small service fee.

This method is best for workers without smartphone access or when internet connections are limited.

SMS & Helpline Options

If you prefer not to use the internet, most banks and exchange houses support SMS banking or 24/7 helplines.

SMS Example: Send “BAL” followed by your card’s last digits to your provider’s code.

- FAB Ratibi: Send to 2121

- Finance House: Send to 3669

- ADIB Payroll: Send to 2404

You’ll receive your current balance instantly via text message.

Helpline Option: Call your provider’s toll-free number (e.g., FAB: 600 52 5500) and follow the IVR menu or speak to a representative. You may need your card number and T-PIN for verification.

These options are reliable, fast, and ideal for users with limited connectivity.

Find full details in the UAE Bank Customer Support Numbers directory.

WPS Salary Card Balance via Ministry Platforms

The Ministry of Human Resources and Emiratisation (MOHRE) provides an official portal to verify whether your employer has processed your salary through the Wage Protection System (WPS).

To check your payment record:

- Visit the MOHRE website or open the MOHRE mobile app.

- Go to the WPS section and enter your Emirates ID or labor card number.

- Review your most recent salary credit record and payment history.

This system confirms your employer’s WPS compliance, even though it doesn’t display your live card balance. It’s the official way to verify that your wages were transferred correctly and on time.

For government-verified salary confirmation, visit the MOHRE Salary Protection Portal.

Salary Card Balance Check by Bank

Each UAE bank or exchange house offers simple ways to check your salary card balance. Most providers support mobile apps, ATMs, online portals, and SMS or helpline options for easy access.

FAB (Ratibi Card) Visit fabcheckbalance.com or use the FAB Mobile App for real-time balance. Two free ATM checks are included monthly; call 600 52 5500 for quick support.

ADCB Check your balance through the ADCB App, website (adcb.com), or send “BAL” to 2626. WhatsApp Banking and “MoneyBuddy” features help track spending.

RAKBANK Use the RAKBANK App, rakbank.ae, or dial *USSD 169# for instant balance checks. Helpline: 600 54 4049.

Emirates Islamic Access via the EI App or emiratesislamic.ae; free checks at EI ATMs.

Al Ansari PayPlus Log in at ppc.magnati.com/ppc-inquiry or use the Al Ansari App. Call 600 54 6000 for support.

Common Salary Card Balance Issues and Solutions

Even the best salary cards can face technical or payroll issues. Knowing the common problems helps you fix them fast and keep your wages protected.

1. Salary Not Credited or Delayed:

This usually happens due to payroll errors or WPS file delays. First, confirm with your HR department that your Wage Protection System (WPS) file was submitted. If unresolved, contact your card provider’s helpline (e.g., FAB: 600 52 5500, Al Ansari: 600 54 6000). If the delay exceeds 15 days, report it to MOHRE via 800 84.

2. Wrong Balance or Missing Funds:

Check your app or ATM mini-statement for pending deductions. For unauthorized charges, block your card immediately and file a dispute form through your provider.

3. Blocked or Captured Card:

Entering the wrong PIN three times or ATM errors can freeze your card. Visit a branch with your Emirates ID or call customer support for reactivation or replacement.

Tips for Managing Your Salary Card Securely

Protecting your salary card is crucial to keeping your wages and data safe. Follow these practical tips to minimize fraud and unauthorized access.

Do’s:

- Use official apps and websites for all balance checks or transactions.

- Set strong, unique PINs or T-PINs and change them regularly.

- Enable SMS or app alerts for instant transaction updates.

- Withdraw only what you need and keep your card safely stored.

Don’ts:

- Never share your PIN, OTP, or card details, even with supposed bank staff.

- Avoid public Wi-Fi when logging into banking portals.

- Don’t ignore alerts about suspicious activity report them immediately.

Be aware of phishing scams that request card or OTP information. Remember, no legitimate bank or exchange will ever ask for your PIN or password by phone or email.

FAQs on Salary Card Balance Check in UAE

1. How can I check my salary card balance in the UAE?

You can check it through your mobile app, ATM, official website, SMS, or by calling your provider’s helpline.

2. Can I check my salary card balance online?

Yes. Visit your provider’s website (e.g., fabcheckbalance.com or ppc.magnati.com), enter your card details, and view your balance instantly.

3. Is there a fee for checking my salary card balance?

Balance checks are free through official apps or ATMs from your provider. Using another bank’s ATM may cost between AED 1 and AED 6 per inquiry.

4. What should I do if my salary isn’t credited?

Contact your HR department and card provider first. If not resolved within 15 days, file a complaint with MOHRE via 800 84.

5. How do I reset my salary card PIN?

You can reset it using your card provider’s mobile app, online portal, or by visiting a branch with your Emirates ID.

6. Can I use my salary card abroad?

Yes, cards from Visa or Mastercard networks can be used internationally, though currency conversion fees may apply.

Final Thoughts

Salary cards are a vital part of the UAE’s Wage Protection System (WPS), ensuring secure, transparent, and timely payments for all workers especially those without traditional bank accounts. By making routine balance checks, employees can confirm salary deposits, detect fraud early, and maintain financial control.

Regular monitoring through mobile apps, ATMs, or online portals helps prevent unauthorized activity and keeps your spending in check. It also ensures your employer remains compliant with MOHRE and WPS regulations, protecting your rights and income transparency.

While salary cards provide convenience and financial inclusion, users should stay alert to avoid small ATM or international transfer fees. Combining awareness, financial literacy, and security habits strengthens your financial independence and stability in the UAE.

Omar Hassan, your trusted guide to navigating the UAE banking landscape. With over 15 years of experience in the industry and a Master’s degree in Finance, Omar leverages his expertise to provide clear and insightful information on balance checking methods, bank comparisons, and financial management tips for UAE residents.