What Is WPS in UAE? Complete Guide to the Wage Protection System (2025 Update)

The Wage Protection System (WPS in UAE) is the country’s electronic payroll framework designed to ensure employees receive their salaries on time and in full. It is a legal requirement for nearly all private sector companies. Introduced by the Ministry of Human Resources and Emiratisation (MOHRE) in collaboration with the UAE Central Bank, the WPS promotes transparency and protects workers from wage delays or underpayment.

This government-monitored system has transformed salary management across the Emirates creating a secure, compliant process that benefits both employers and employees.

Understanding the WPS in the UAE

The Wage Protection System is a nationwide electronic salary transfer mechanism. Its purpose is to protect employee rights and ensure that salaries are paid accurately and on schedule through authorized financial institutions. Before WPS, salary disputes and delayed payments were common in the private sector. The system was introduced to eliminate these issues by creating a transparent digital trail for every salary transaction.

Through WPS, the Ministry of Human Resources and Emiratisation and the Central Bank monitor wage payments across thousands of companies. Each month, employers must submit verified payroll data, and any delay or discrepancy triggers an alert. This ensures that employees are paid promptly and employers remain accountable. WPS is now a cornerstone of labour reform and wage protection in the UAE.

What Does WPS Mean

WPS stands for Wage Protection System. It is an electronic payroll platform created to ensure that all private-sector workers are paid correctly, securely, and within the legal timeframe. Under UAE labour law, WPS registration is mandatory for any company that employs workers under a MOHRE contract.

Employers prepare a Salary Information File, often called an SIF, containing details like employee names, Emirates ID numbers, bank accounts, and salaries. This file is uploaded through a registered bank or exchange and verified by MOHRE and the Central Bank. After approval, funds are transferred directly into employee bank accounts or WPS salary cards.

For employees, this guarantees payment security and provides an official record of every salary deposit. For employers, it ensures payroll compliance and builds trust with both staff and regulators..

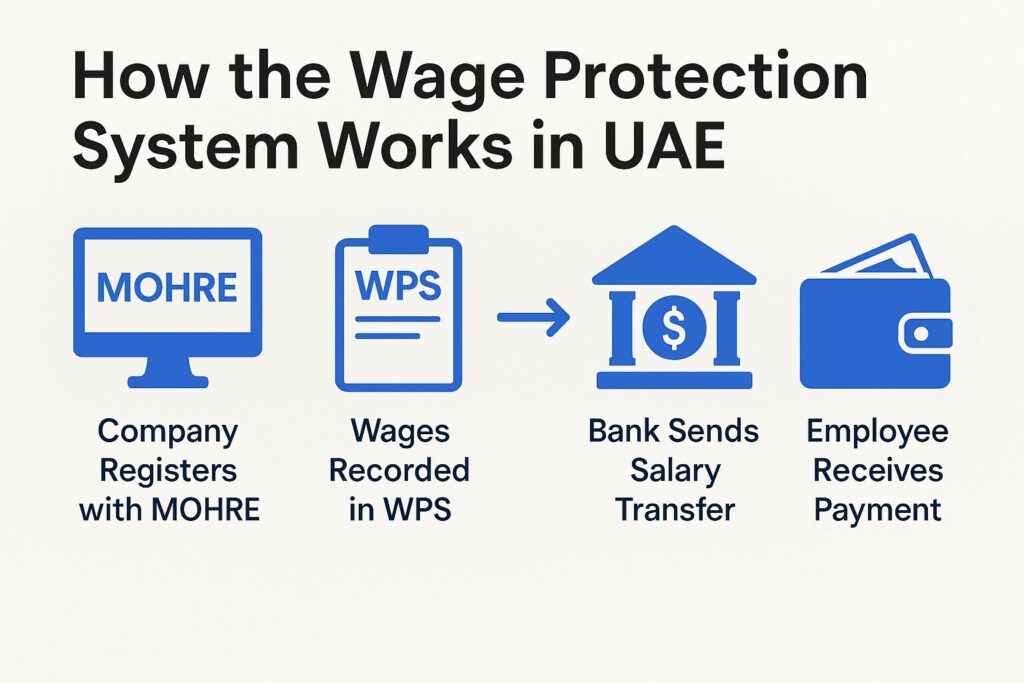

How the Wage Protection System Works in UAE

The Wage Protection System operates through a structured process. Companies register with MOHRE and partner with an approved bank or exchange. Once the payroll cycle begins, employers upload a verified Salary Information File for all employees. The system checks each record against MOHRE data before salaries are released.

Step 1 is employer registration. A company must obtain a MOHRE establishment card, open a corporate account, and sign a WPS agreement with a licensed financial institution.

Step 2 is employee account setup. Each employee must have either a bank account or a WPS salary card from providers such as C3Pay, Al Ansari, or RAKBANK.

Step 3 is SIF submission. The employer uploads the file through their bank portal. Once verified, the Central Bank releases the payments to employee accounts, creating a complete record for both employer and worker.

Authorities Managing the WPS

The Wage Protection System is jointly managed by the Ministry of Human Resources and Emiratisation and the Central Bank of the UAE. MOHRE oversees compliance, employee registration, and salary reporting, while the Central Bank manages financial channels and payment verification. Together, they ensure that all transactions meet the country’s labour and banking standards.

The Ministry tracks every salary transfer through digital monitoring tools. If a company fails to pay on time, the system automatically flags the violation, leading to penalties or work permit suspension. The Central Bank ensures that only licensed banks and exchanges handle WPS transactions to prevent fraud and maintain financial integrity.

This collaboration makes the UAE one of the few countries with a fully integrated, government-backed payroll system that ensures financial fairness for all employees.

WPS Salary Payment Process

WPS salary transfers follow a monthly cycle. Employers prepare the Salary Information File, send it to their WPS-registered bank, and wait for verification. Once approved by MOHRE and the Central Bank, the bank disburses salaries directly to employee accounts or WPS cards.

Payments are usually released between the first and tenth of each month. A salary is considered delayed if unpaid after fifteen days from the due date. Employees receive SMS alerts or can check through mobile apps or salary cards.

All transactions are recorded digitally, giving both employers and employees an auditable payment history. This system guarantees that wages are processed transparently and without delay.

How to Check WPS Salary or Company Status Online

Employees and HR managers can verify salary payments and company WPS status online. This ensures compliance and helps prevent wage disputes.

To check your salary via MOHRE, visit mohre.gov.ae, open the Services menu, and select Wage Protection System or New Enquiry Services. Enter your Labour Card, Emirates ID, or passport number to see payment records.

To confirm company registration, go to the Company Information service on the same portal. Enter the company license or establishment number to view whether it is active or penalized.

Employees can also track payments through WPS-enabled banks or cards such as C3Pay, RAKBANK, or Al Ansari. If an issue arises, contact your HR department or MOHRE at 80060.

WPS Registration Process for Employers

All mainland and most free zone companies must register under WPS. The process begins with opening a corporate account at a UAE-licensed bank approved for WPS. The employer then registers with MOHRE, obtains an establishment card, and signs a WPS agreement with their financial institution.

Next, the employer gathers employee data, including full names, labour card details, and salary information. The company must prepare and submit a Salary Information File each month through its chosen bank or exchange.

Registration fees vary, but employers typically pay processing charges to banks or exchanges. Employees cannot be charged for WPS-related fees.

Maintaining an active registration requires up-to-date trade and establishment licenses. Regular renewals ensure smooth payroll processing and legal compliance.

WPS Compliance and UAE Labour Law

WPS is governed by Ministerial Decree No. 739 of 2016 and subsequent Cabinet resolutions. These laws require companies to pay employees within ten days of their due date.

Employers must pay at least ninety percent of staff salaries through WPS every month and ensure that each employee receives at least eighty percent of the contractual wage. Failure to comply can lead to fines, work permit suspension, and downgrade of company classification.

Common violations include late payments, incorrect SIF data, and paying in cash. MOHRE closely monitors violations and can impose fines starting from one thousand dirhams per employee. Serious or repeated breaches can reach fifty thousand dirhams and lead to criminal referral.

WPS in Dubai and Across Emirates

The Wage Protection System operates across all Emirates with federal oversight from MOHRE. In Dubai, the system covers mainland companies and major free zones like JAFZA, DMCC, and DIFC. Partner banks include Emirates NBD, Mashreq, and RAKBANK.

In Abu Dhabi, WPS is managed through MOHRE in cooperation with the Central Bank and local banks like FAB and ADCB. Sharjah follows the same structure, supported by RAKBANK, Finance House, and exchange partners.

While core rules are uniform, certain smaller free zones have their own wage systems. Nonetheless, the same compliance principles apply across all Emirates.

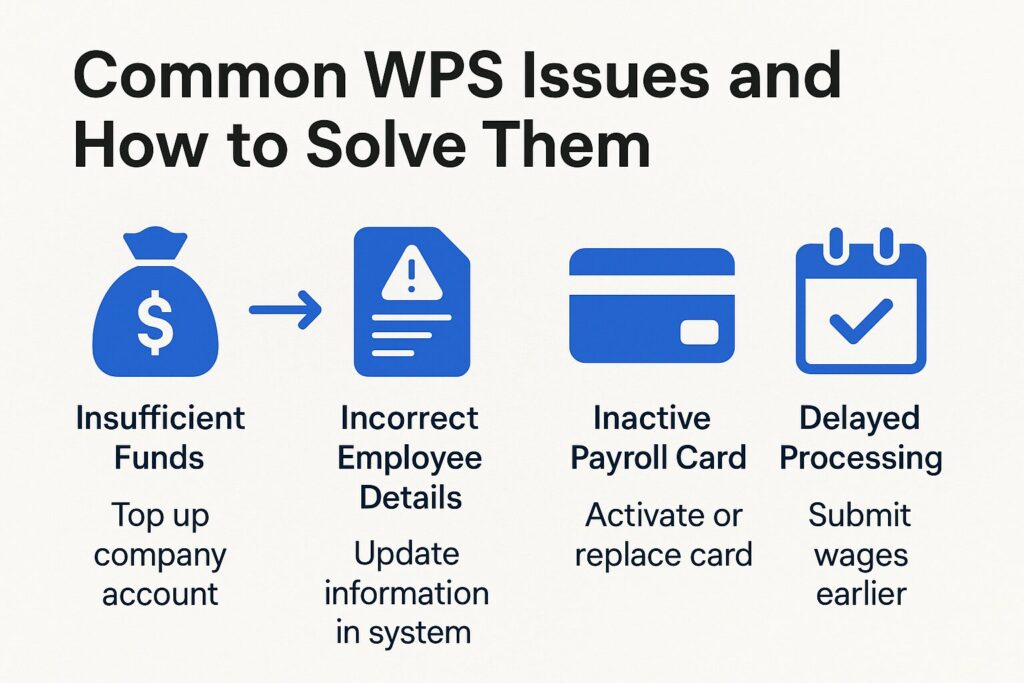

Common WPS Issues and How to Solve Them

The most common problems include salary delays, incorrect amounts, rejected files, and blocked WPS access.

If a salary is delayed for over fifteen days, employees should first contact HR. If unresolved, they can file a complaint through MOHRE’s website, app, or hotline. Incorrect salary payments must be corrected through updated SIF submissions.

Employers whose files are rejected must fix data errors such as invalid IBANs or incorrect names before resubmitting. Companies blocked from WPS must settle all dues and provide proof of payment to MOHRE to lift restrictions.

MOHRE usually resolves complaints within three to five business days.

Benefits of the WPS System

WPS brings clear advantages to both employees and employers. For employees, it ensures secure, on-time salary payments and protects against wage theft or disputes. Every transaction is recorded, creating proof of income that helps in visa applications, loans, and financial planning.

For employers, WPS simplifies payroll management, guarantees legal compliance, and reduces administrative errors. Paying through WPS strengthens reputation, builds staff confidence, and prevents costly penalties.

As of 2025, more than ninety-nine percent of UAE private sector workers are covered by WPS, making it one of the most effective payroll systems globally.

Future of WPS in UAE (2025 and Beyond)

The UAE continues to enhance WPS through technology and expanded coverage. As of 2025, the system includes domestic workers in select professions such as private teachers and caregivers.

The next phase focuses on full digital integration with fintech and AI-driven payroll tools. These updates will detect errors in real time, automate verification, and improve efficiency for both employers and regulators.

MOHRE also aims to achieve full financial inclusion by linking WPS with digital wallets and payroll apps, enabling workers without traditional bank accounts to receive payments securely.

The country’s long-term goal is a fully traceable, cashless payroll ecosystem that guarantees wage protection for all.

FAQs About WPS in UAE

What is the Wage Protection System in UAE

It is an electronic salary transfer system that ensures employees are paid accurately and on time through government-monitored financial channels.

Who must register for WPS

All mainland companies and most free zones registered under MOHRE must comply with WPS payroll regulations.

What happens if a company delays salary payments

Salaries unpaid after fifteen days are marked late. MOHRE may suspend work permits and issue fines starting from one thousand dirhams per employee.

How can I check if my salary was paid through WPS

Visit the MOHRE website or app, select Wage Protection System, and enter your Labour Card or Emirates ID to view payment details.

Can I be paid in cash under WPS

No. Salaries must be paid electronically through a registered WPS bank or exchange.

What is a Salary Information File

A Salary Information File is the digital payroll report that employers submit to WPS authorities each month for salary approval and transfer.

Conclusion

The Wage Protection System is the foundation of salary transparency and worker protection in the UAE. It ensures employees are paid in full, on time, and through trusted financial channels. By mandating electronic transfers and continuous monitoring, WPS has made salary delays and disputes rare in the private sector.

For employers, WPS is both a legal obligation and an ethical standard that promotes fairness and operational stability. For employees, it provides peace of mind and financial security backed by the government.

As the UAE continues to modernize its labour systems, WPS remains central to building a fair, digital, and compliant work environment for all.

Omar Hassan, your trusted guide to navigating the UAE banking landscape. With over 15 years of experience in the industry and a Master’s degree in Finance, Omar leverages his expertise to provide clear and insightful information on balance checking methods, bank comparisons, and financial management tips for UAE residents.