PayPlus Salary Card Balance Check: Al Ansari Payroll Card Guide (2025 Update)

The PayPlus Salary Card by Al Ansari Exchange is a simple and secure way for employees in the UAE to receive their salaries under the Wage Protection System (WPS). It helps workers especially those without bank accounts get fast access to their pay, withdraw cash easily, and manage money safely.

This 2025 guide explains all the ways to PayPlus Salary Card Balance Check online, through the app, at ATMs, or in Al Ansari branches along with the latest card features and support options.

What is the Al Ansari PayPlus Salary Card?

The Al Ansari PayPlus Salary Card is a reloadable Visa prepaid card used by UAE employers to pay salaries under the Wages Protection System (WPS). Regulated by the Central Bank of the UAE and issued by Al Ansari Exchange, it lets employees receive and access their wages securely without needing a bank account.

Salaries are transferred through Al Ansari’s WPS payroll system and automatically loaded onto each employee’s card. This ensures fast, transparent, and compliant payments every month.

Who Can Get It

The card is available to all private-sector workers whose employers are registered under WPS especially useful for employees without bank accounts.

Key Benefits

- WPS compliant and approved by MOHRE and the Central Bank

- No bank account needed salaries go straight to the card

- Free withdrawals at Al Ansari Exchange branches

- Global Visa access for purchases and ATM use

- No minimum balance or hidden fees

- Secure PIN transactions and 24/7 customer support

- Digital control through the Al Ansari app or website

The PayPlus card supports the UAE’s drive for financial inclusion, helping thousands of workers manage salaries easily through Al Ansari’s digital and branch network.

How to Check Your PayPlus Salary Card Balance (2025 Methods)

In 2025, Al Ansari Exchange offers five official and secure ways to check your PayPlus Salary Card balance online, through the mobile app, at ATMs, in branches, or via customer support. These methods are quick, convenient, and designed to help every worker under the UAE’s Wage Protection System (WPS) access their salary safely.

Official PayPlus Balance Check Methods

- Online (Website Portal) Visit the official PayPlus inquiry page at ppc.magnati.com/ppc-inquiry or access it through the Al Ansari Exchange website.

Enter your card number and Card ID, complete the CAPTCHA, and view your balance instantly no login required. Works on both desktop and mobile browsers. - Mobile App Use the Al Ansari Exchange App (iOS, Android, or Huawei) for real-time balance updates, statement downloads, and instant salary notifications. The app features biometric login, multi-language support, and in-app card lock/unlock for secure access.

- ATM Inquiry Insert your PayPlus card at any Al Ansari, First Abu Dhabi Bank (FAB), Mashreq, RAKBANK, or any Visa network ATM.

Select Balance Inquiry to view or print your balance. Al Ansari ATMs are free, while non-partner ATMs may charge a small fee. - Branch Visit Visit the nearest Al Ansari Exchange branch with your Emirates ID and PayPlus card. A representative will check your balance or print your statement free of charge. Branches operate daily, with extended evening hours across all emirates.

- SMS or Customer Care Call 600 54 6000 (available 8 AM–12 Midnight) or use the registered SMS service for quick balance inquiries.

Support is available in multiple languages for all WPS cardholders. Always confirm the official SMS format before sending messages.

Security and Data Privacy

Al Ansari Exchange ensures all PayPlus balance check services follow strict Central Bank of the UAE security standards. Data is protected through SSL encryption, PIN verification, and multi-factor authentication where applicable.

Security tips:

- Use only official Al Ansari channels (website, app, or verified numbers).

- Always check for https:// in URLs before entering card details.

- Never share your PIN, OTP, or full card number.

- Avoid third-party websites or links claiming to offer balance inquiries.

These verified methods make it easy to stay on top of your salary, manage expenses, and ensure your WPS payments arrive safely and on time.

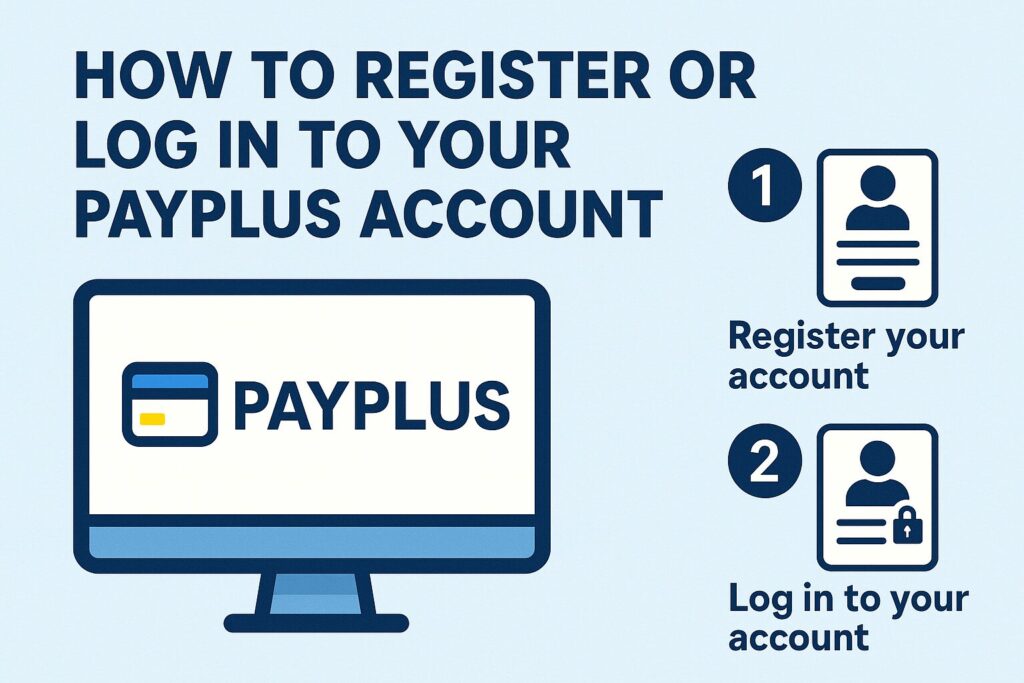

How to Register or Log In to Your PayPlus Account

To manage your PayPlus Salary Card online, you’ll need a PayPlus account through the Al Ansari Exchange app or website. Once activated, it lets you check balances, view salary statements, download transaction history, and control your card securely anytime, anywhere.

How to Register for PayPlus Online Access

Most employees receive a PayPlus card when their company joins the UAE Wage Protection System (WPS). You only need to complete the registration to unlock full digital access.

What you’ll need

- Valid Emirates ID

- PayPlus card number and expiry date

- UAE-registered mobile number

- Internet-enabled device

Steps to register

- Download the Al Ansari Exchange App from the Google Play Store, Apple App Store, or Huawei AppGallery.

- Tap “Sign Up.” Choose UAE PASS for instant setup or continue with manual entry.

- Enter your Emirates ID, mobile number, and email, then create a strong password.

- Verify with the OTP sent to your mobile.

- Complete e-KYC verification to confirm identity.

- Link your PayPlus card by entering the 16-digit number and expiry date.

- Set a 4-digit PIN and enable biometric login (fingerprint / Face ID).

- Review and accept the terms and conditions to activate your account.

How to Log In

- Via App: Open the Al Ansari Exchange App, then log in using your password, UAE PASS, or biometric login.

- Via Website: Go to alansariexchange.com → Login → enter credentials → access dashboard.

An OTP may be sent for extra verification.

Forgot Password or PIN?

- Password Reset: Tap “Forgot Password” → verify via SMS OTP or email → create a new password.

- Card PIN Reset: Call 600 54 6000 or visit any Al Ansari Exchange branch with your Emirates ID.

Important Notes

- Your card is usually activated on issuance; completing app registration gives full online control.

- Since PayPlus is part of your employer’s WPS setup, the company initiates the account, and you finalize registration.

- Keep your mobile number and email updated to receive OTPs and salary alerts.

Security Best Practices

- Use strong, unique passwords.

- Never share your PIN, OTP, or login details.

- Log out after using shared devices.

- Only use the official Al Ansari Exchange app or website (look for https://).

- Enable biometric authentication for quicker, safer access.

Registering your PayPlus account is quick, secure, and the easiest way to manage your salary digitally.

PayPlus Card Features and Services (2025 Update)

The Al Ansari PayPlus Salary Card, powered by Visa, is a prepaid payroll solution built for secure, fast, and cashless salary access in the UAE. In 2025, it introduces smarter digital tools, instant transaction updates, and better global usability helping employees manage their earnings anytime, without needing a bank account.

Top PayPlus Card Features in 2025

1. Instant Salary & Transaction Alerts

Receive real-time mobile notifications whenever your salary is credited or a transaction occurs. You can also set low balance alerts and customize how you receive updates through the Al Ansari Exchange app.

2. Free Cash Withdrawals Across UAE

Withdraw cash free of charge at any Al Ansari Exchange branch or partner ATMs such as FAB and Mashreq. The card also works at all Visa ATMs worldwide standard network fees apply for non-partner ATMs.

3. Complete In-App Account Management

Check balances, view recent transactions, or download detailed monthly statements directly from the app. Statements can be exported as PDFs for free, and real-time balance updates reflect as soon as funds are credited.

4. Card Lock, Replacement & Fraud Protection

Easily lock or unlock your card within the app if misplaced. For lost or stolen cards, permanent blocking and instant deactivation are available. Replacements can be issued at any Al Ansari branch.

5. Multilingual Experience

The PayPlus interface supports English and Arabic, while customer support offers assistance in Hindi, Urdu, Tagalog, and Bengali ensuring language accessibility for all workers across the UAE.

6. Fast, WPS-Compliant Salary Processing

Wages are transferred through the UAE Wage Protection System (WPS) and usually reach your card within 24 to 48 hours. You’ll receive a notification once funds are available for use.

7. Global Visa Access

Use your PayPlus card for purchases, ATM withdrawals, or online shopping anywhere Visa is accepted. Multi-currency transactions are supported, with automatic conversion at Visa’s global exchange rate.

8. Contactless & Digital Wallet Payments

Add your card to Apple Pay, Google Pay, or Samsung Pay for easy, tap-and-go payments. Every transaction uses Visa’s tokenization technology, which replaces sensitive card data with encrypted tokens for safer contactless payments.

9. Biometric & Enhanced Security

Log in securely using fingerprint or Face ID. All online transactions are protected with SSL encryption, PIN authentication, and continuous fraud monitoring by Al Ansari Exchange and Visa.

10. Zero Minimum Balance & Transparent Fees

No minimum balance or monthly maintenance fees apply. Balance checks, in-app statements, and branch inquiries are all completely free ensuring full transparency with no hidden costs.

Additional PayPlus Services

- International Money Transfers: Send remittances to 200+ countries from any Al Ansari Exchange branch at competitive exchange rates.

- Bill Payments: Pay utility bills, telecom bills (Etisalat, du), and credit cards directly using your PayPlus card balance.

- Mobile Top-Ups: Recharge UAE or international prepaid mobile numbers easily at any branch.

- Nationwide Branch Access: Access 270+ Al Ansari Exchange locations across all seven emirates, open late and on weekends.

- 24/7 Support: Get help anytime via the Al Ansari customer care hotline (600 54 6000), in-app chat, or branch service desks.

Why PayPlus Stands Out in 2025

The 2025 PayPlus upgrade combines speed, accessibility, and total digital control, giving every employee under the UAE’s Wage Protection System (WPS) a reliable, cost-free way to manage their salary. With Visa-powered global access, instant salary alerts, and secure mobile management, it’s one of the most advanced payroll card solutions in the UAE today.

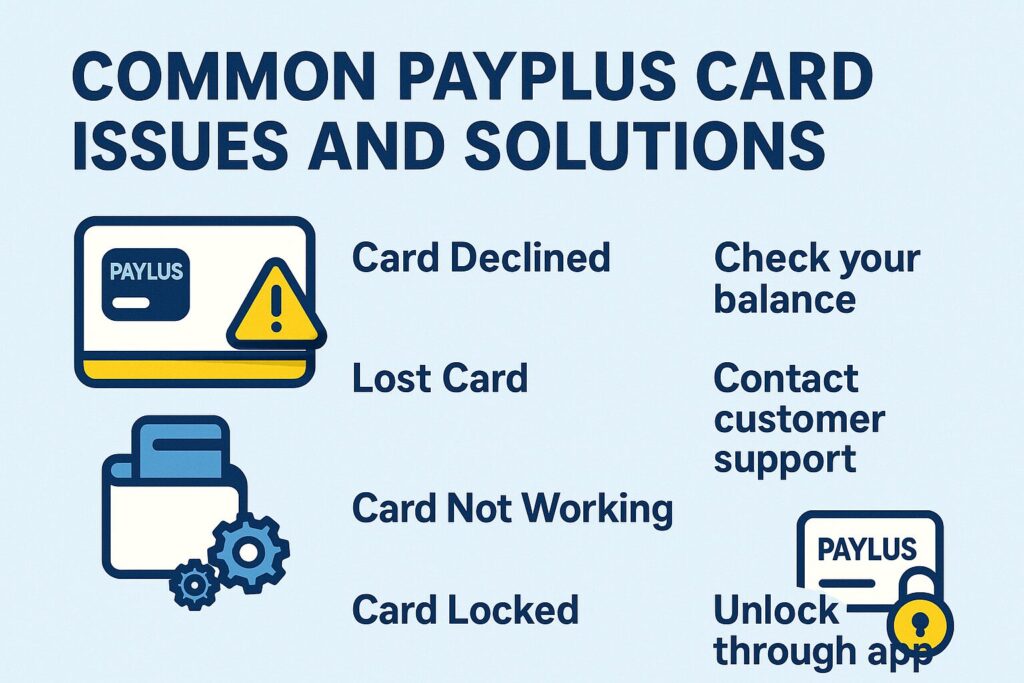

Common PayPlus Card Issues and Solutions

Even reliable payroll systems can face small issues from time to time. Below are the most common PayPlus Salary Card problems, their likely causes, and quick, verified solutions. All steps follow Al Ansari Exchange’s 2025 support policies and Central Bank of UAE WPS guidelines.

1. Balance Not Updating

Why it happens: Payroll file delay or WPS processing lag.

Fix it:

- Wait 24–48 hours after your company processes salaries.

- Refresh the app or log out and back in.

- Confirm with your employer that the WPS file was submitted correctly.

- If not updated, call 600 54 6000 with your Emirates ID and card number.

Tip: WPS salary files are usually credited within two business days of processing.

2. PayPlus App Not Loading

Why it happens: Outdated version, poor network, or cached data.

Fix it:

- Update to the latest Al Ansari Exchange app.

- Clear app cache or reinstall the app.

- Switch between Wi-Fi and mobile data.

- Disable any VPN connection.

- For persistent errors, email [email protected].

Tip: Always download the official app from the Google Play, Apple, or Huawei store.

3. Forgotten or Blocked PIN

Why it happens: Three incorrect PIN attempts automatically lock the card.

Fix it:

- Stop trying to re-enter the PIN.

- Call 600 54 6000 or visit any Al Ansari branch.

- Bring your Emirates ID to verify your identity.

- Resetting the PIN is free of charge.

4. Lost, Stolen, or Damaged Card

Why it happens: Card misplaced, stolen, or chip damage.

Fix it:

- Instantly lock or block the card through the app.

- Call 600 54 6000 or +9714 377 2640 immediately.

- Report theft to local police if needed.

- Request a replacement card at any branch (a small fee may apply).

5. Transaction Declined or Failed

Why it happens:

- Insufficient balance

- Incorrect PIN entry

- Network error at ATM or POS terminal

Fix it: - Check your balance before retrying.

- Re-enter your PIN correctly.

- Use another ATM or merchant terminal.

- If still declined, contact customer care to check for technical or security holds.

6. Card Blocked or Suspended

Why it happens: Repeated wrong PINs or suspected fraud activity.

Fix it:

- Contact customer care to confirm the reason.

- Verify your identity to reactivate the card.

- If due to suspicious activity, confirm recent transactions for security clearance.

7. Salary Delay or Missing Credit

Why it happens: Employer processing error or incorrect WPS file details.

Fix it:

- Confirm with HR that your salary has been sent.

- Allow up to 48 hours for WPS salary processing.

- If still missing, call Al Ansari support with your transaction details or payroll ID.

- Keep salary slips or transaction IDs for investigation.

8. Unauthorized Transactions

Why it happens: Card or card data compromised.

Fix it:

- Immediately call +9714 377 2640 or email [email protected].

- Download and submit the dispute form within 30 days of the transaction.

- Block the card and monitor your app for new activity.

- A replacement card will be issued after verification.

9. OTP or Login Issues

Why it happens: Outdated mobile number or network delays.

Fix it:

- Check your registered mobile number in your app profile.

- Wait 2–3 minutes, then resend OTP.

- Ensure your SIM card is active and not full.

- Log in via UAE PASS if the OTP still doesn’t arrive.

10. How to Escalate Unresolved Issues

If your problem continues after following these steps:

- Call: 600 54 6000 (8:00 AM – Midnight, 7 days a week)

- Email: [email protected] (include card number & reference ID)

- Visit: your nearest Al Ansari Exchange branch

- Escalate: File a formal complaint with the Sanadak Consumer Protection Unit sanadak.gov.ae

Prevention Tips

- Keep your PIN, CVV, and OTP private.

- Avoid using public Wi-Fi for balance checks.

- Update your mobile number and email regularly.

PayPlus Customer Support and FAQs (UAE 2025)

Need help with your PayPlus Salary Card? Al Ansari Exchange offers 24/7 multilingual customer support to help with everything from salary delays and PIN resets to reporting lost or stolen cards. Here’s how to reach the right team and solve common issues quickly.

1. Why hasn’t my salary appeared yet?

Salaries are usually credited within 24–48 hours after WPS file submission. If it’s delayed, confirm with your employer first, then call 600 54 6000.

2. What are the daily limits on my PayPlus card?

- ATM withdrawal: up to AED 9,000 (USD 2,500) per day

- POS & online: limited by card balance and merchant rules

- International use: Visa network fees may apply

3. Can I check my balance for free?

Yes via the Al Ansari Exchange app, website, branches, or call center.

(Non-partner ATMs may charge a small fee.)

4. What should I do if my card is lost or stolen?

- Call +971 4 377 2640 immediately to block your card.

- Report theft to a branch or local police if needed.

- Replacement cards cost AED 25 + VAT.

5. How can I dispute an unauthorized transaction?

- Notify Al Ansari within 30 days of the debit date.

- Call +971 4 377 2640 or email [email protected].

- Fill and submit the dispute form (keep a copy for your employer).

6. My PIN is disabled how do I reset it?

After three wrong attempts, your card is blocked for safety.

- Call 600 54 6000 or visit a branch with Emirates ID to reset it free of charge.

7. How do I get my transaction history or statement?

- App: Download a PDF for free.

- Branch: Get a stamped printout for AED 20 + VAT (up to 6 months).

8. Can I transfer money using my PayPlus card?

Yes. Visit any Al Ansari branch to send money locally or abroad.

You can also transfer funds to an Al Ansari Wallet if you’re registered.

9. Is there a minimum balance requirement?

No — the PayPlus card has no minimum balance and no monthly fees.

10. How can I update my contact details?

- Mobile number: Update in-person at a branch (for security reasons).

- Email address: Update through the app under My Profile → Edit Email → verify via OTP.

Final Thoughts

The Al Ansari PayPlus Salary Card stands out as one of the UAE’s most trusted payroll solutions, built to make salary access simple, fast, and secure for workers under the Wage Protection System (WPS). It’s especially useful for employees without traditional bank accounts, offering a direct and reliable way to receive wages across all Emirates.

PayPlus combines the benefits of a Visa-powered prepaid card with the convenience of digital tools allowing users to withdraw cash, make global purchases, and check balances anytime through the Al Ansari Exchange app or website. With free in-branch withdrawals, 24/7 customer support, and multilingual assistance, it remains one of the most accessible options for workers in 2025.

However, users should understand its limits. The PayPlus card is a stored-value payroll card, not a full bank account. It doesn’t earn interest, and using non-partner ATMs may involve small fees. That said, its zero minimum balance requirement, transparent pricing, and wide acceptance make it ideal for day-to-day salary use.

To manage your card effectively in 2025:

- Check your balance regularly through the app, website, or Al Ansari branch.

- Use the mobile app for real-time updates, instant statements, and secure card control.

- Keep your PIN and login details safe never share your OTP or credentials.

- Report any unauthorized activity immediately to Al Ansari customer care.

- Stay informed about PayPlus updates, security features, and WPS rights to protect your wages.

Omar Hassan, your trusted guide to navigating the UAE banking landscape. With over 15 years of experience in the industry and a Master’s degree in Finance, Omar leverages his expertise to provide clear and insightful information on balance checking methods, bank comparisons, and financial management tips for UAE residents.