Minimum Salary for Credit Card in UAE: Don’t Get Rejected Read This First

Understanding the minimum salary for credit card in UAE is key before applying. Getting a credit card isn’t just about having a job your monthly income determines which cards you qualify for. Every bank follows the Central Bank of UAE (CBUAE) guidelines, which set a minimum salary requirement, typically around AED 5,000 per month for unsecured credit cards. This rule helps banks assess repayment ability and manage risk under the 50% Debt Burden Ratio (DBR) regulation.

If your income is lower, don’t worry options like secured or deposit-backed credit cards can still help you start building a strong credit history. On the other hand, higher earners can access premium cards that offer exclusive travel perks, cashback, and lifestyle rewards.

In this 2025 guide, we’ll break down salary brackets, eligibility criteria, self-employed options, and real examples from major UAE banks so you can find a credit card that perfectly matches your income level and financial goals.

What Is the Minimum Salary Required for a Credit Card in UAE?

The minimum salary requirement in the UAE is the lowest monthly income banks accept before approving a credit card. This rule ensures responsible lending and protects borrowers from excessive debt. The Central Bank of the UAE (CBUAE) sets regulatory guidelines under which total debt payments can’t exceed 50 % of your income known as the Debt Burden Ratio (DBR).

For most banks, the minimum salary for unsecured credit cards starts at AED 5,000 per month.

No standard cards are issued below this level.

Entry-level options like RAKBANK Red, Emirates NBD Lulu 247, and ADCB SimplyLife start around AED 5,000. Mid-range cards from FAB or Mashreq may need AED 8,000–15,000, while premium products such as HSBC Skywards Infinite can reach AED 30,000 or more.

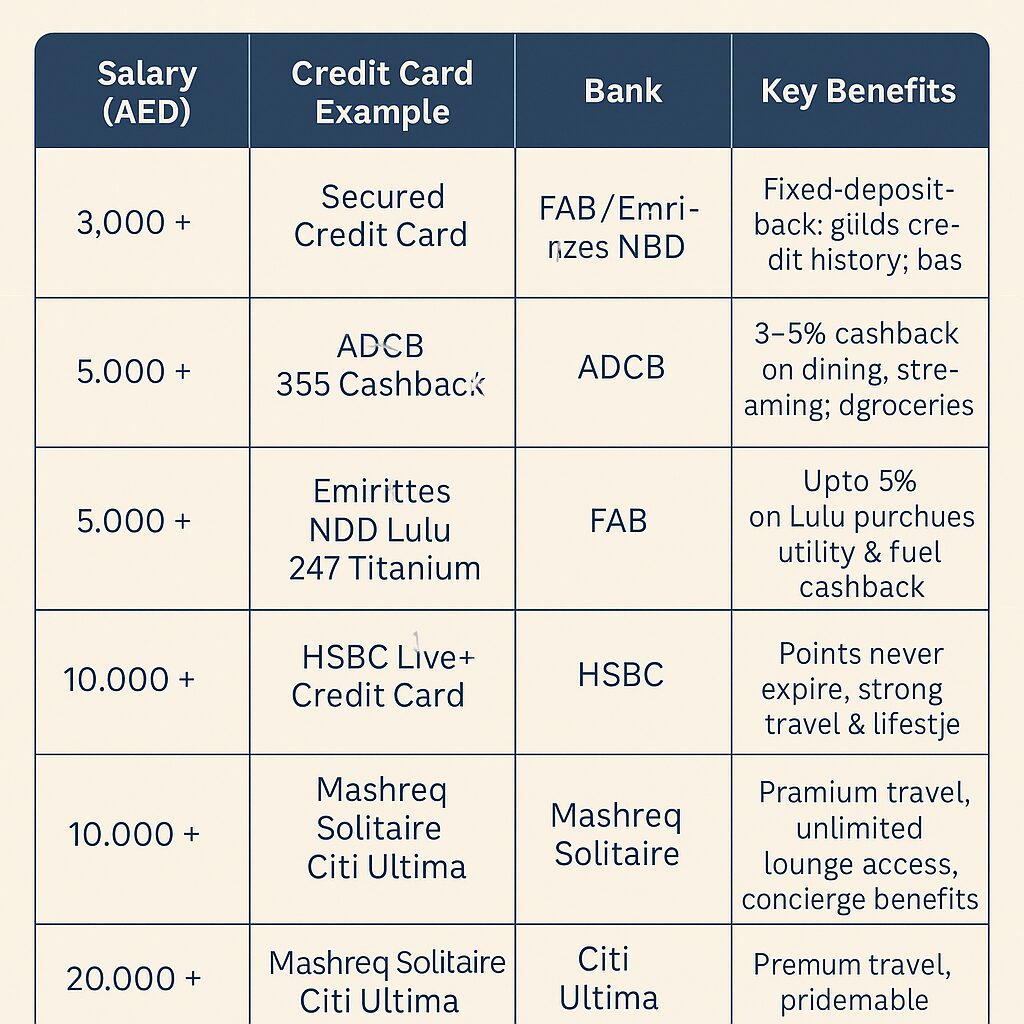

Credit Card Salary Requirements in UAE (By Income Bracket)

Credit card eligibility in the UAE depends heavily on your monthly income bracket. Each salary range unlocks access to different card types, benefits, and limits. Banks use salary tiers to manage credit risk and tailor perks from essential cashback cards to premium travel options.

Below AED 5,000, standard unsecured cards aren’t available due to banking regulations. However, applicants can choose secured cards, which require a fixed deposit as collateral. Once you reach AED 5,000, most major banks including Emirates NBD, RAKBANK, and FAB open access to entry-level credit cards with basic rewards and low fees.

As your salary climbs beyond AED 10,000, higher-tier cards offer airport lounge access, travel insurance, concierge services, and better cashback rates.

The more you earn, the wider the benefits but also the stricter the credit-score checks.

Credit Cards for AED 2,000–3,000 Salary

If you earn AED 2,000–3,000 per month, you won’t qualify for unsecured cards — UAE banks set AED 5,000 as the minimum for credit-based products. Still, you can build credit using a secured credit card.

These cards require a fixed deposit, usually AED 5,000–30,000, which becomes your credit limit. The bank holds this amount as collateral, reducing its risk. Cards like Emirates NBD Secured Credit Card or ADCB FD-Linked Card are common examples.

Alternatively, you can use prepaid or debit cards for everyday payments, though these won’t help your credit score.

Starting with a secured card and paying bills on time helps you qualify for unsecured cards once your salary and credit score improve.

Credit Cards for AED 4,000–5,000 Salary

At this level, unsecured cards remain limited but become available once you hit AED 5,000 monthly income. Banks like RAKBANK, ADCB, FAB, Mashreq, and Emirates NBD offer entry-level cards for salaried employees with stable income and clean credit records.

Popular choices include the RAKBANK Red, Emirates NBD Lulu 247 Titanium, and ADCB Talabat Platinum.

Benefits include 1–2 % cashback, interest-free periods up to 55 days, and low annual fees.

Most cards at this tier feature modest limits between AED 3,000–10,000. Approval is easier if your salary is transferred to the issuing bank.

Consistent payments and account history at this level help unlock platinum and signature cards later on.

Credit Cards Above AED 5,000 Salary

Once your salary crosses AED 5,000, a broad range of unsecured and premium credit cards opens up.

For AED 5,000–10,000, banks offer “Classic, Gold, and Titanium” cards featuring basic rewards, 3–5 % cashback, and occasional travel insurance.

At AED 10,000–20,000, “Platinum” or “Signature” cards add airport lounge access, extended insurance, and air miles.

Above AED 20,000, ultra-premium cards such as RAKBANK World, HSBC Skywards Infinite, or Citi Ultima deliver concierge services, unlimited lounge access, and luxury perks.

Higher salaries also mean larger credit limits sometimes exceeding AED 100,000 but banks demand strong AECB scores and stable job history.

How to Get a Credit Card with Low Salary in UAE

Getting a credit card with a low income in the UAE is possible if you follow the right approach. If you earn below AED 5,000, you won’t qualify for an unsecured card, but banks offer secured credit cards. These cards require a fixed deposit (usually AED 5,000–10,000), which becomes your credit limit. It’s the safest way to build a credit history when your salary is modest.

Step-by-step process:

Credit Card Options Without Salary Transfer

Not everyone wants to move their salary to a new bank — especially freelancers, expats, or self-employed professionals. Fortunately, many UAE banks now offer no-salary-transfer (NST) credit cards that accept alternative income proof.

Examples include:

- Citibank Simplicity Card: No annual or late payment fees, AED 5,000 minimum salary.

- HSBC Live+ and Max Rewards: No transfer required but higher salary (AED 12,500+).

- Emirates Islamic Flex Cards: Shariah-compliant, flexible eligibility.

- ADCB and Mashreq Cashback Cards: For expats and freelancers earning AED 5,000+.

You’ll need to provide 3–6 months of bank statements, a salary certificate, and often a security cheque.

These cards give flexibility to maintain your main account elsewhere, though banks may charge slightly higher fees or set lower credit limits.

Credit Cards for Self-Employed and Freelancers in UAE

Getting a credit card as a self-employed professional or freelancer in the UAE is possible but comes with stricter checks. Since income can fluctuate, banks assess financial stability using average account balances instead of fixed salaries.

To qualify, you typically need:

- A valid UAE trade license or freelance permit from a recognized free zone (e.g., DMCC, Dubai Media City).

- Business or personal bank statements for 6–12 months, showing steady deposits.

- A minimum average balance of AED 5,000–10,000 (some banks like Emirates NBD may require AED 50,000+ for premium cards).

- A positive AECB credit score and at least 6–12 months of business activity.

Top options include cards from ADCB, FAB, Mashreq, Dubai Islamic Bank, and Emirates NBD, all offering cashback, travel benefits, or Sharia-compliant choices.

Documents and Eligibility Criteria for Credit Card Approval

Before applying for a credit card in the UAE, make sure you have the correct documents and meet the bank’s eligibility criteria. These help verify your identity, residency, and financial capacity.

Essential documents include:

- Emirates ID and passport copy (with residence visa).

- Salary certificate or trade license, depending on employment type.

- Bank statements for the last 3–6 months (6–12 months for freelancers).

- Proof of address utility bill, tenancy contract, or EJARI.

- Optional: financial statements or a security cheque (some banks require this).

Common rejection reasons:

- Income below AED 5,000 or inconsistent deposits.

- Low credit score or high debt-to-income ratio.

- Missing or outdated documents.

- Applying to several banks at once.

Fix it by: clearing existing dues, improving your AECB score, and maintaining regular income flow for at least six months before reapplying.

Best Credit Cards in UAE by Minimum Salary Requirement (2025)

Credit card eligibility in the UAE depends heavily on your monthly salary bracket. Below is a quick comparison of the top cards and their features:

Insight:

- AED 5,000 – 10,000: best entry-level cashback cards.

- AED 10,000 – 20,000: travel and lifestyle cards.

- AED 20,000 +: elite luxury benefits.

Tips to Improve Credit Card Eligibility and Approval Chances

UAE banks assess applicants based on income stability, debt ratio, and credit history. Follow these expert tips to boost your approval odds:

- Meet the salary requirement: AED 5,000 is the minimum for unsecured cards — lower incomes should consider secured options.

- Keep your AECB score above 650. Pay bills and EMIs on time to maintain a clean record.

- Maintain consistent salary deposits for at least 3–6 months before applying.

- Reduce existing debt. Keep your debt-to-income ratio under 50 % (ideally < 30 %).

- Apply through your primary bank. They already have your salary record, which increases trust.

- Avoid multiple applications too many inquiries lower your score.

- Provide complete documentation: Emirates ID, salary certificate, visa, and recent bank statements.

- If new to UAE: start with a secured card to build history, then upgrade later.

FAQs Minimum Salary Credit Cards in UAE (2025)

1. What is the lowest salary required for a credit card in the UAE?

The minimum monthly salary for an unsecured credit card is AED 5,000. This benchmark aligns with Central Bank of UAE lending norms. Below this level, only secured or prepaid cards are typically available.

2. Can I get a credit card with a 3,000 AED salary?

No unsecured cards aren’t issued below AED 5,000. However, FAB, Emirates NBD, and Mashreq offer secured credit cards backed by fixed deposits, helping you build a credit profile safely.

3. Does the minimum salary include allowances or bonuses?

Only your fixed monthly income listed on the salary certificate usually counts. Some banks may include consistent allowances, but bonuses are excluded.

4. Which banks approve AED 5,000 salary cards?

Top options include Emirates NBD (Lulu 247 Titanium), ADCB (365 Cashback), FAB (du Rewards Indulge), Mashreq (Cashback), and RAKBANK (RED).

5. Do I need to transfer my salary to get a card?

Not always. Citi, HSBC, ADCB, and Standard Chartered allow non-salary-transfer cards, provided your documents and income are consistent.

6. What’s the minimum credit score for approval?

Most UAE banks require an AECB credit score of 650 or above. Premium cards often start around 700+.

7. What documents are needed?

Emirates ID, passport + visa copy, salary certificate, and 3–6 months’ bank statements. Freelancers must add trade license and income proof.

Final Thoughts Choosing the Right Credit Card for Your Income (2025)

Choosing the right credit card in the UAE starts with understanding your income bracket and focusing on cards that match your financial comfort level.

If your salary is below AED 5,000, unsecured credit cards are not available but secured or prepaid cards can help you build credit responsibly. For those earning AED 5,000–10,000, entry-level cards like Emirates NBD Lulu 247 Titanium, ADCB 365 Cashback, and Mashreq Cashback deliver solid rewards and no annual fees.

Mid-tier earners (AED 10,000–20,000) can access premium “Platinum” cards with better cashback, travel perks, and lounge access, while those earning AED 20,000+ qualify for elite “Signature” or “Infinite” cards offering luxury benefits, concierge services, and unlimited lounge access.

Always weigh fees, interest rates, and realistic usage before applying. A card’s true value lies in how it fits your spending habits not just the perks.

Omar Hassan, your trusted guide to navigating the UAE banking landscape. With over 15 years of experience in the industry and a Master’s degree in Finance, Omar leverages his expertise to provide clear and insightful information on balance checking methods, bank comparisons, and financial management tips for UAE residents.