Best Cash Back Credit Cards in UAE (2025) – Compare the Top Cashback Offers

The best cashback credit cards in UAE have become some of the most popular financial tools, rewarding you with instant money-back savings on everyday purchases instead of complicated reward points. With each eligible transaction, you can earn between 1% and 10% cashback credited directly to your account or statement. These cards turn daily spending into real savings while offering extra travel, lifestyle, and entertainment perks.

In 2025, UAE banks are introducing more personalized cashback programs than ever — from zero-annual-fee cards for everyday users to premium cards offering exceptional returns on groceries, dining, and fuel. Whether you’re a frequent shopper, traveler, or family spender, the right cashback card can help you save more and spend smarter.

This comprehensive guide compares the best cashback credit cards in the UAE, highlights current offers and rates, and helps you find the perfect card that matches your lifestyle and financial goals

What Is a Cash Back Credit Card and How Does It Work?

A cashback credit card rewards you by returning a fixed percentage of your eligible spending as cash. Instead of earning points or miles, you receive direct savings—usually applied to your monthly statement or transferred to your bank account. UAE banks design these cards to suit real-life spending categories like groceries, dining, fuel, utilities, and online shopping.

Cashback programs operate on either a flat-rate system, where you earn the same percentage on every purchase, or a category-based structure offering higher returns in select areas. For example, the FAB Cashback card gives 5% on groceries, dining, and fashion, while Citi Cashback provides 3% on international spending.

In short, these cards help you save automatically by rewarding your regular purchases with tangible, easy-to-track cash rebates.

Understanding Cashback Rewards and Rates

Cashback rewards are calculated as a percentage of your spending, typically from 1% to 10%, depending on the category. UAE banks use tiered systems—higher rates for essential categories like dining or groceries, and lower for utilities or government payments.

Some cards feature spending caps; for example, HSBC Live+ offers 6% on dining but limits monthly cashback to AED 200. Flat-rate cards like Citi Cashback have no cap, making them ideal for high spenders seeking predictability.

Average UAE cashback rates in 2025 range from 1% on general spending to 10% on select premium tiers. Understanding these limits ensures you earn consistent returns without exceeding category caps.

How to Redeem Your Cashback Rewards

Redeeming cashback is simple and entirely digital. Most UAE banks credit your cashback automatically as a statement reduction, while others allow direct transfers to your savings or current account.

Some hybrid programs let you redeem cashback for gift vouchers or convert it into travel miles. For example, CBD Super Saver allows direct account redemption once AED 50 is accumulated, and Mashreq Cashback requires AED 100 before payout.

Redemption usually happens via online or mobile banking, with funds credited within a few business days. The process is transparent, ensuring easy access to your savings anytime.

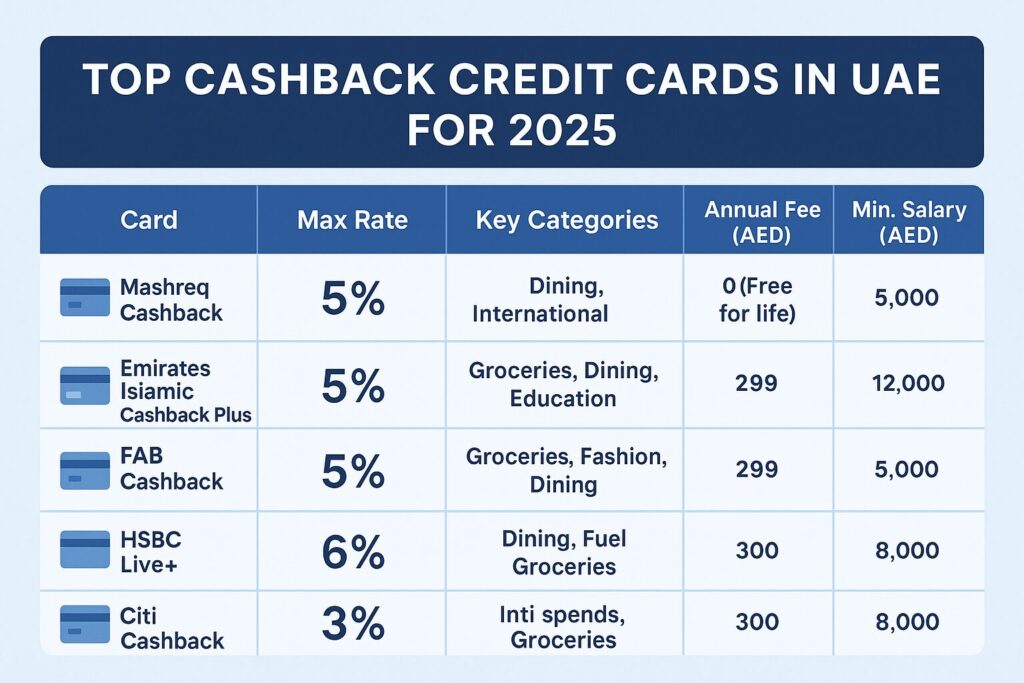

Top Cashback Credit Cards in UAE for 2025

In 2025, leading UAE banks have enhanced their cashback programs to match diverse consumer needs. From fee-free options for everyday spenders to premium travel-focused cards, there’s something for everyone.

The best choice depends on your lifestyle—Mashreq for unlimited value, Emirates Islamic for high-category returns, or FAB for balance and perks.

Top Cashback Credit Card Offers from UAE Banks

Dubai’s major banks frequently launch limited-time bonuses for new applicants. For example, RAKBANK World offers AED 750 welcome cashback until Oct 31 2025, while Mashreq Cashback provides AED 500 on AED 5,000 spend in two months.

FAB Cashback gives a first-year fee waiver and AED 500 bonus with qualifying spend, and HSBC Live+ rewards new users with an AED 800 Amazon voucher by Nov 30 2025.

These promotions reward active early spending and can add significant short-term value to your annual cashback total.

Highest Cashback Cards for Maximum Savings

For high spenders, the difference between capped and unlimited cards is critical. Mashreq Cashback offers 5% with no cap, while Emirates Islamic Cashback Plus gives 10% but limits monthly cashback to AED 200 per category.

If you spend AED 15,000 per month, an uncapped 5% card often yields higher real savings than capped 10% options. Flat-rate cards like Citi Cashback provide consistent, uncapped returns—ideal for global or business users.

Compare Cashback Credit Cards by Spending Category

Maximizing your cashback means using the right card for each expense type. UAE cards specialize by category—groceries, dining, utilities, or online shopping—helping you capture the highest rate across your lifestyle.

| Category | Top Card | Max Rate | Key Notes |

| Groceries | Emirates Islamic Cashback Plus | 10% | Best for Carrefour & Lulu spends |

| Dining | ADCB 365 | 6% | Includes Talabat and Zomato orders |

| Utilities | CBD Super Saver | 10% | Covers DEWA, Etisalat, du bills |

| Online Shopping | Mashreq Cashback | 5% | Valid on Amazon and Noon |

Using multiple cards for category-specific spending ensures the best return each month.

Best Cashback Credit Card for Groceries and Supermarkets

Groceries are one of the largest household expenses, and certain UAE cards deliver excellent returns. Emirates Islamic Cashback Plus and CBD Super Saver both offer up to 10% cashback at Carrefour, Lulu, and Spinneys.

FAB Cashback follows with 5% for supermarket and fashion purchases. If you prefer simplicity, Citi Cashback guarantees 2% on groceries without category caps.

Dining and Restaurant Cashback Credit Cards

Food lovers can earn generous returns through cards like ADCB 365 Cashback (6% on restaurants and delivery) and Mashreq Cashback (5% on all dining, unlimited).

HSBC Live+ also provides 6% on dining and food delivery, plus Zomato Gold benefits. These cards reward both sit-down meals and delivery orders via Talabat or Deliveroo.

Utility Bill Cashback Credit Cards

Utility payments like DEWA, Etisalat, and du are eligible for cashback with select banks. CBD Super Saver and Emirates Islamic Cashback Plus lead with 10% returns on bills, while ADCB 365 offers 3% on utilities and fuel.

These cards help you save on non-negotiable expenses by rewarding regular payments directly through bank channels.

Online Shopping and E-Commerce Cashback Cards

For digital buyers, Mashreq Cashback and Standard Chartered X offer up to 5–10% cashback on online shopping at Amazon.ae, Noon, and Namshi. Citi Cashback adds 3% on international e-commerce transactions without caps.

These cards maximize savings for frequent shoppers and cross-border buyers who prefer digital payments.

Cashback Credit Card Offers and Promotions in Dubai

Dubai banks regularly introduce seasonal and event-based offers linked to popular retail brands and festivals. During events like the Dubai Shopping Festival, many cards offer 10–25% enhanced cashback on purchases at Dubai Mall and Mall of the Emirates.

HSBC Live+ and FAB Cashback partner with Careem, Talabat, and Zomato for extra discounts and mobile-wallet rewards. CBD Super Saver and Emirates Islamic extend cashback at ENOC fuel stations and Emaar entertainment venues like Reel Cinemas and VR Park.

These localized promotions help Dubai residents maximize savings on daily activities and entertainment.

How to Choose the Best Cashback Credit Card for You

Choosing the right cashback card depends on income, spending pattern, and preferred merchants.

- Salary AED 5k–8k: Choose no-fee cards like Mashreq Cashback or FAB Cashback.

- Frequent diner: Opt for HSBC Live+ or ADCB 365.

- Online shopper: Try Standard Chartered X or Mashreq Cashback.

- High spenders: Emirates Islamic Cashback Plus or Liv. Cashback Plus offer higher caps.

Always check minimum spend requirements and monthly earning limits to maximize returns.

Compare Cashback Rates and Reward Limits

Caps can reduce effective earnings. For instance, a card offering 10% cashback capped at AED 200 means you earn that maximum after spending AED 2,000. Beyond that, the rate drops to 0%.

Unlimited cards like Mashreq Cashback or Citi Cashback avoid this issue, providing consistent returns for high spenders. Always compare effective rates over time, not just headline percentages.

Annual Fees, Eligibility, and Application Requirements

Most UAE banks require a minimum salary of AED 5,000 to AED 12,000, a valid Emirates ID, passport, residence visa, and salary certificate. Annual fees range from AED 0 to AED 300, often waived for the first year or after meeting spending thresholds.

Maintain a clean credit score to ensure quick approval and higher limits.

No Annual Fee Cashback Cards and Salary Transfer Options

Top no-fee choices include Mashreq Cashback, RAKBANK Titanium, and CBD Super Saver. While some premium cards offer better rewards for salary transfer customers, most UAE banks don’t require it, allowing flexibility in choosing your main account.

Fee-free cards ensure pure savings without extra costs.

FAQs About Cashback Credit Cards in UAE

Q1. What is a cashback credit card?

It’s a credit card that returns a percentage of your spending—usually 1% to 10%—as cash or statement credit on eligible purchases like groceries, dining, and fuel.

Q2. Which is the best cashback card in the UAE?

Top picks include Mashreq Cashback (unlimited, no fee), Emirates Islamic Cashback Plus (up to 10%), and Citi Cashback (3% international spend). The best choice depends on your lifestyle.

Q3. Do cashback cards have earning limits?

Yes, most cards cap monthly cashback between AED 150–600 per category. Cards like Mashreq and Citi Cashback offer no caps for unlimited earning potential.

Q4. Who can apply for cashback credit cards in the UAE?

Applicants must be 21+, hold a UAE residence visa and Emirates ID, and earn at least AED 5,000–12,000 monthly, depending on the bank’s criteria.

Q5. Do supplementary cards earn cashback too?

Yes, purchases on supplementary cards also earn cashback, which is credited to the primary cardholder’s account, helping families combine rewards efficiently.

Q6. Are cashback rewards taxable in the UAE?

No, cashback isn’t taxable. The UAE has no personal income tax, so your cashback is treated as a discount, not income.

Q7. How can I redeem my cashback?

You can redeem cashback as a statement credit, bank transfer, or voucher through online or mobile banking—usually processed within a few days.

Q8. How long does cashback take to credit?

Cashback is credited at the end of each billing cycle, typically within 3–5 business days after your statement closes.

Q9. Do cashback cards require salary transfer?

Most don’t. You can apply without moving your salary, though some banks offer extra benefits for customers who do.

Q10. Can I use more than one cashback card?

Yes, many users carry multiple cards to earn the highest cashback per category—for example, one for groceries and another for fuel or dining.

Final Thoughts – Find the Best Cashback Card for Your Lifestyle

Cashback credit cards turn everyday spending into real savings. They reward you for purchases you already make groceries, dining, or fuel while offering valuable extras like travel benefits and discounts.To maximize returns, select a card that matches your spending profile and budget. If you want simplicity, choose Citi Cashback; for high category rates, go with Emirates Islamic Cashback Plus; for overall value, Mashreq Cashback remains a standout free-for-life choice.

Used wisely, a cashback card can help you save hundreds of dirhams each month while making spending more rewarding.

Omar Hassan, your trusted guide to navigating the UAE banking landscape. With over 15 years of experience in the industry and a Master’s degree in Finance, Omar leverages his expertise to provide clear and insightful information on balance checking methods, bank comparisons, and financial management tips for UAE residents.